Kenorland Minerals announces major grassroots gold discovery with intersects up to 29m at 8.47 g/t Au, including 11.13m at 18.43 g/t Au, at Regnault, in the Frotet-Evans Belt of Quebec

July 29, 2020

Vancouver, British Columbia, July 29, 2020 – Kenorland Minerals Limited (Private) (“Kenorland” or “the Company”) is pleased to report the discovery of significant gold mineralization in multiple drill hole intersections at the Regnault target of its Frotet Project in the Frotet-Evans Greenstone Belt, Quebec, Canada. Complete results from the 15 drill hole maiden program, funded by Sumitomo Metal Mining Canada Limited (“SMMCL”), are summarized below.

Highlights include:

- The discovery of a new significant gold system in the Frotet Evans greenstone belt in an area with no known mineral occurrences or historic drilling

- Initial drilling encountered high grade gold mineralization associated with quartz veins along with lower grade, broadly disseminated gold mineralization

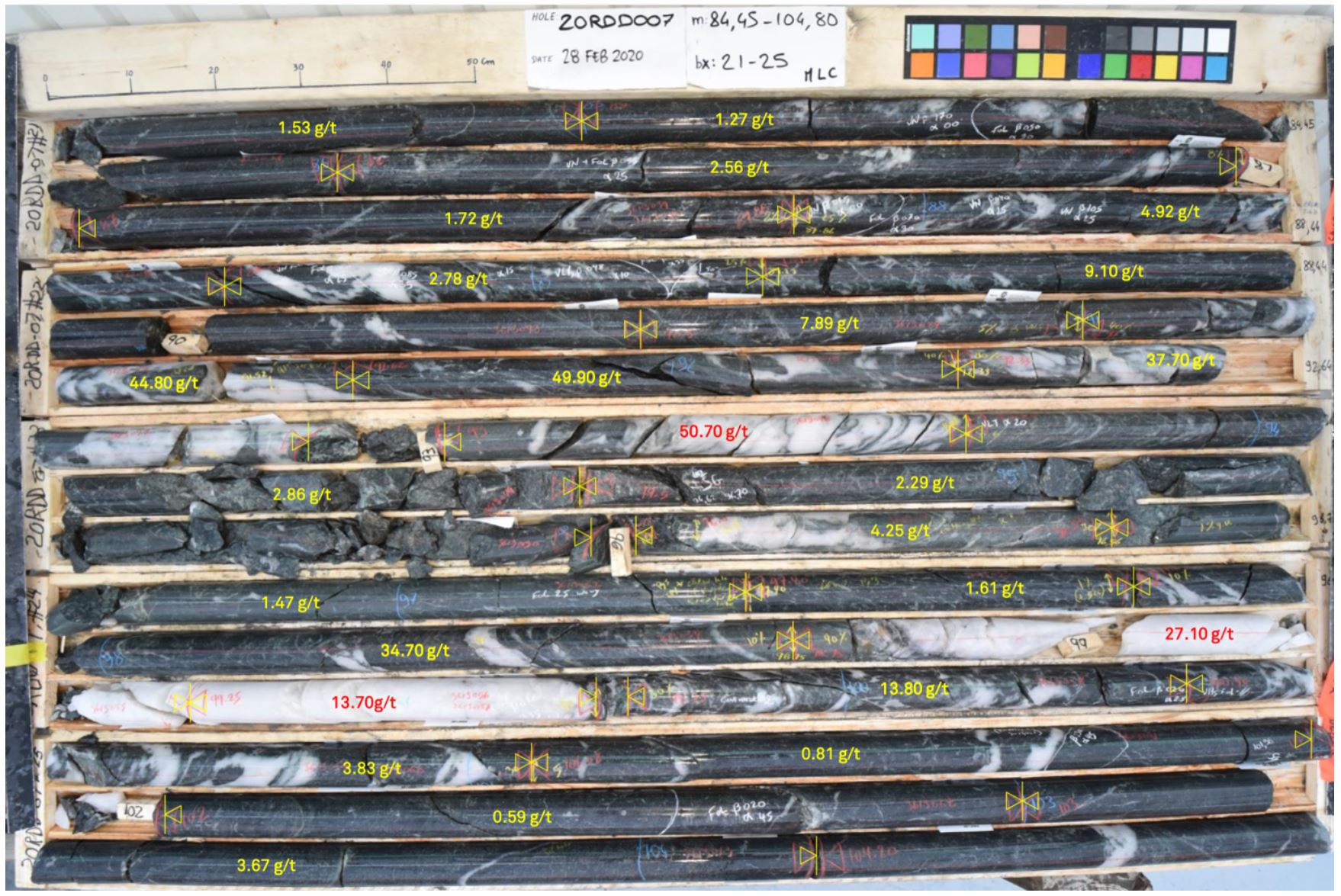

- Results from 20RDD007 intersected 29.08m at 8.47 g/t Au including 11.13m at 18.43 g/t Au

- Recognition of geological controls and geophysical expressions of gold mineralization which will aid in targeting for future drill programs

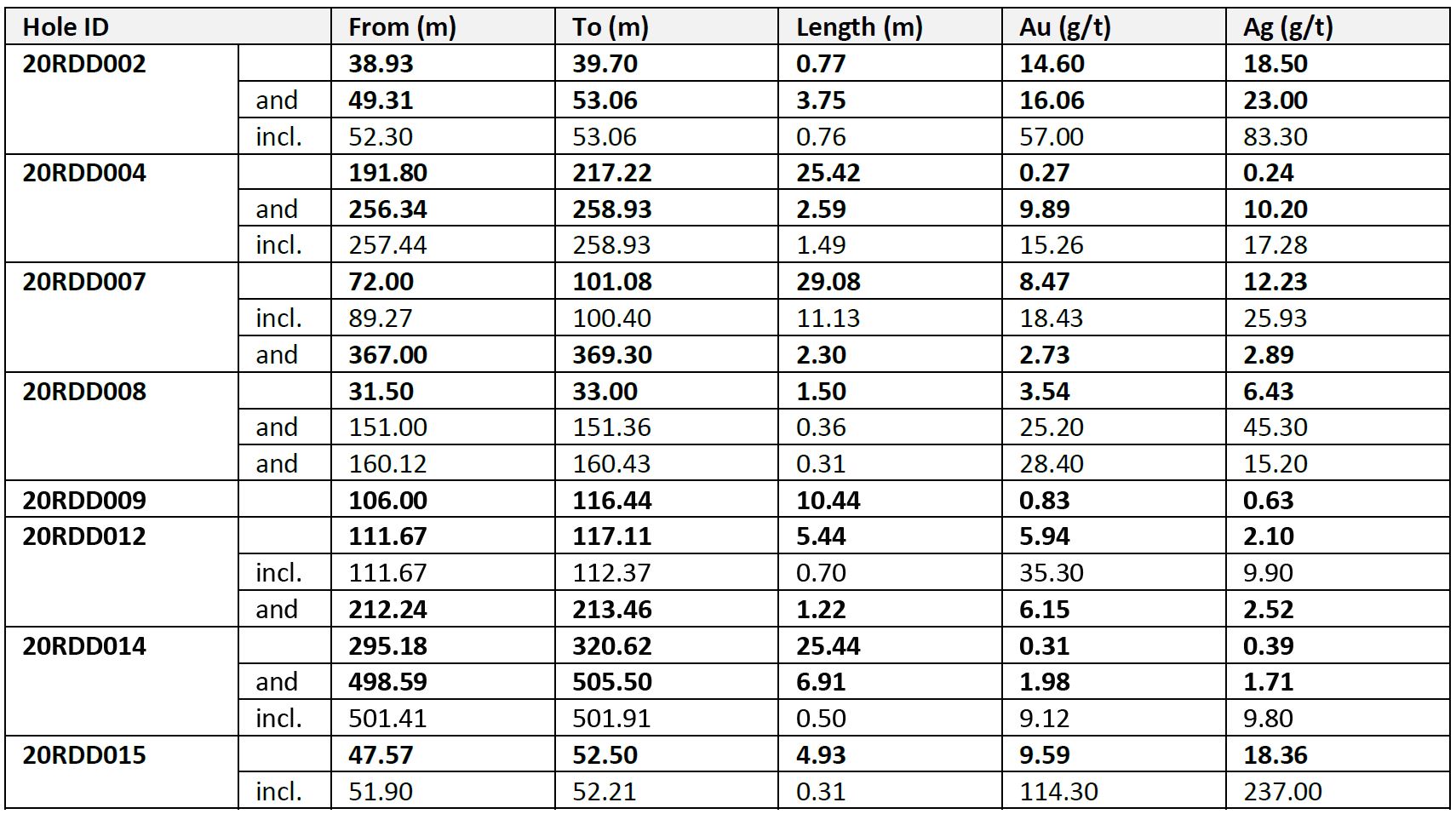

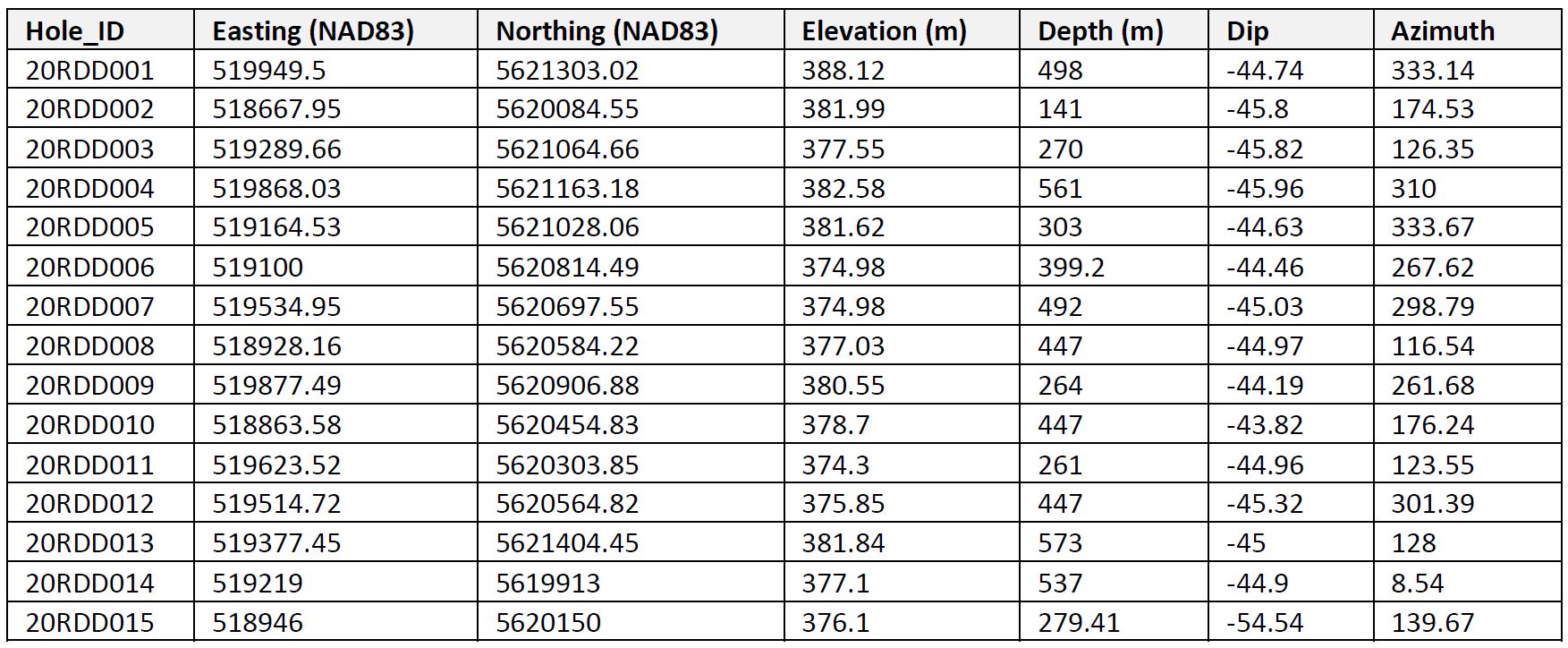

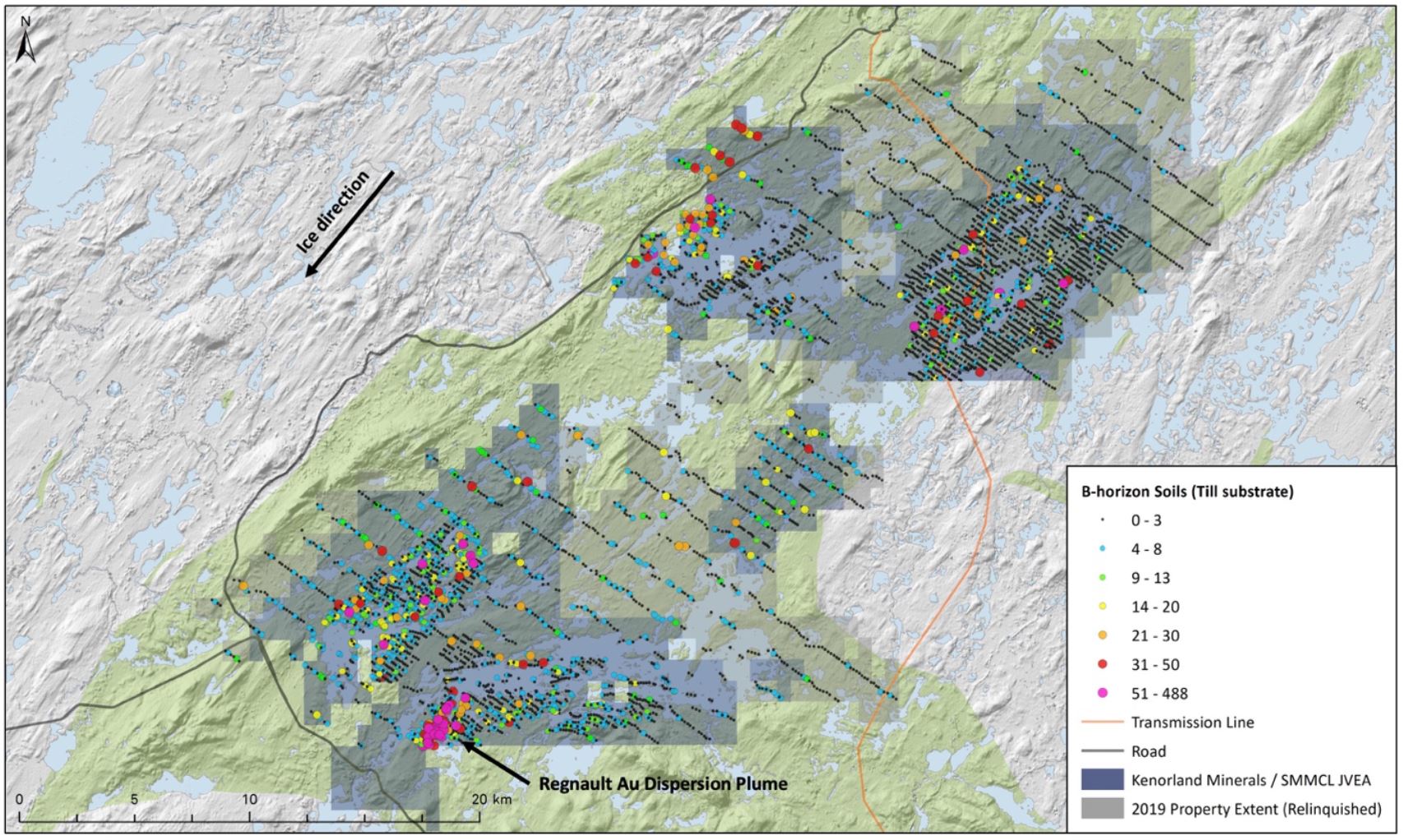

Table 1. Summary of Significant Intercepts

The Regnault discovery is hosted in a multi-phase intrusive complex that ranges in composition from tonalite to diorite that intrudes into a package of intermediate block, lapilli and crystal tuffs that are located in a zone of structural complexity along an east-west trending regional deformation zone. Visible gold is observed in quartz veins hosted within biotite-calcite-pyrite-silica altered intrusive rocks. Gold mineralization is also associated with broadly disseminated pyrite hosted in zones of intense biotite-calcite alteration, along contacts of the intrusive phases. Mineralization observed in drill core is similar to that of boulders found in the Regnault target area in 2019, which assayed up to 408 g/t Au. The mineralized boulders were found within a significant gold in soil (glacial till substrate) dispersion anomaly directly down ice of the area being drilled.

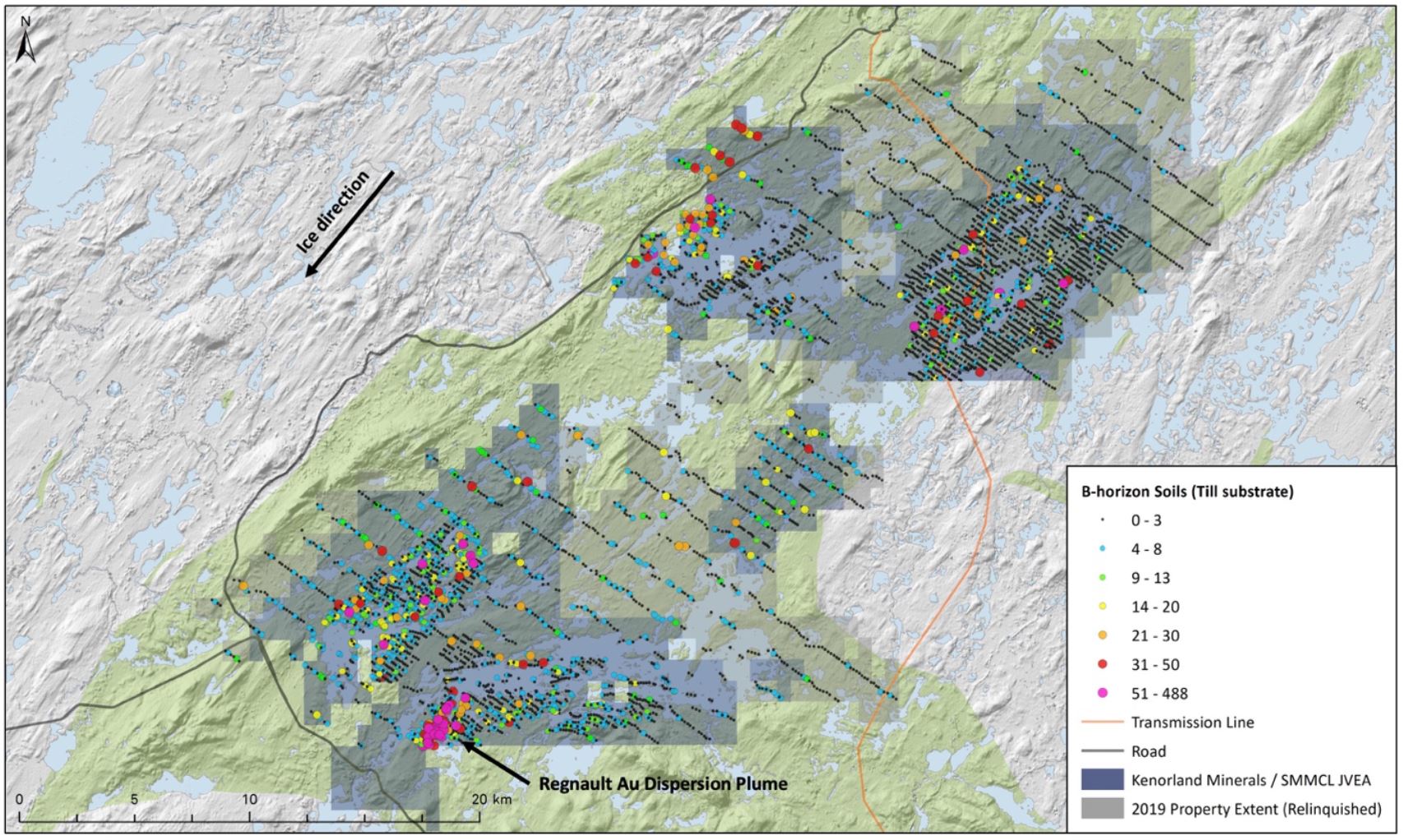

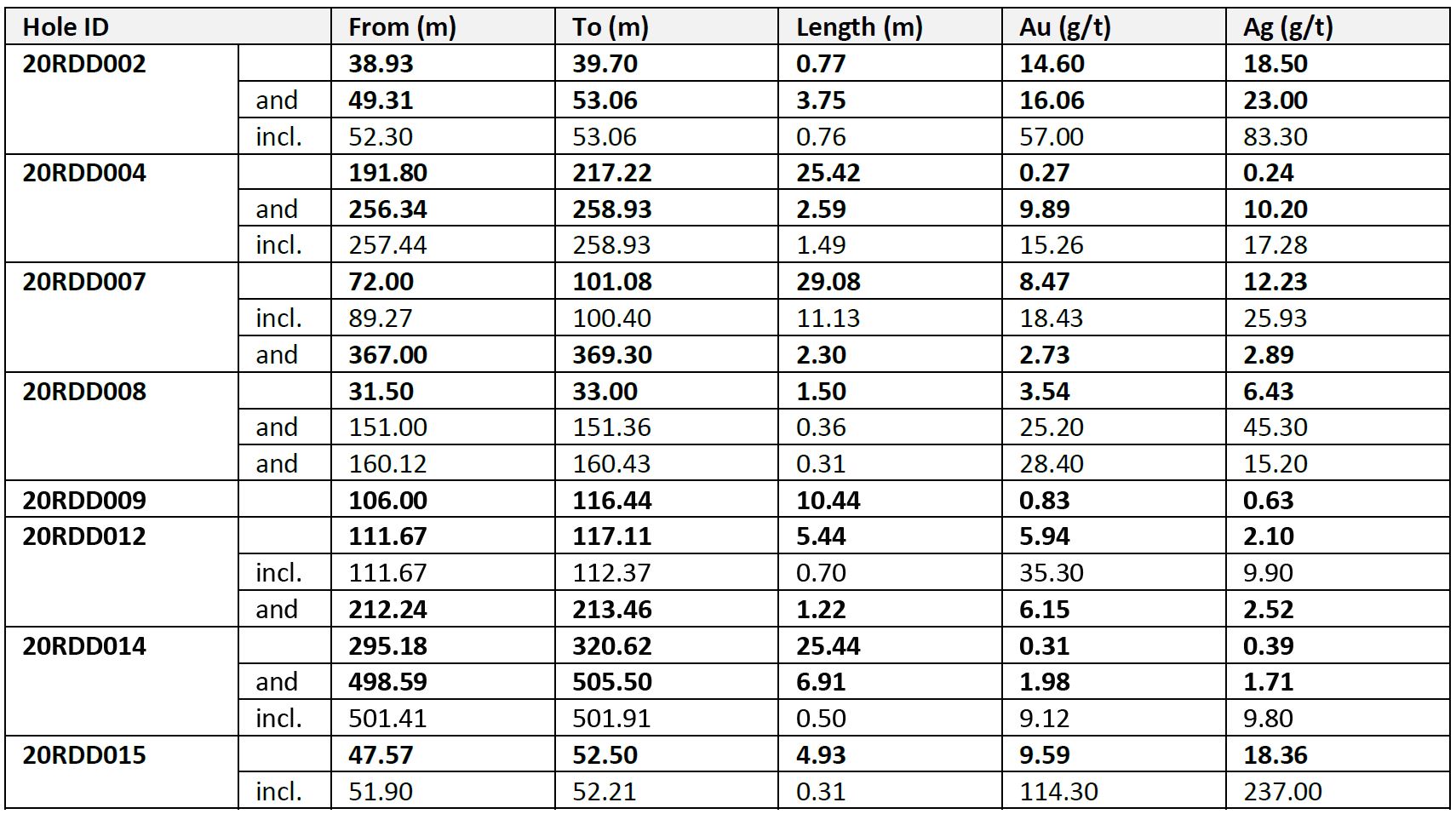

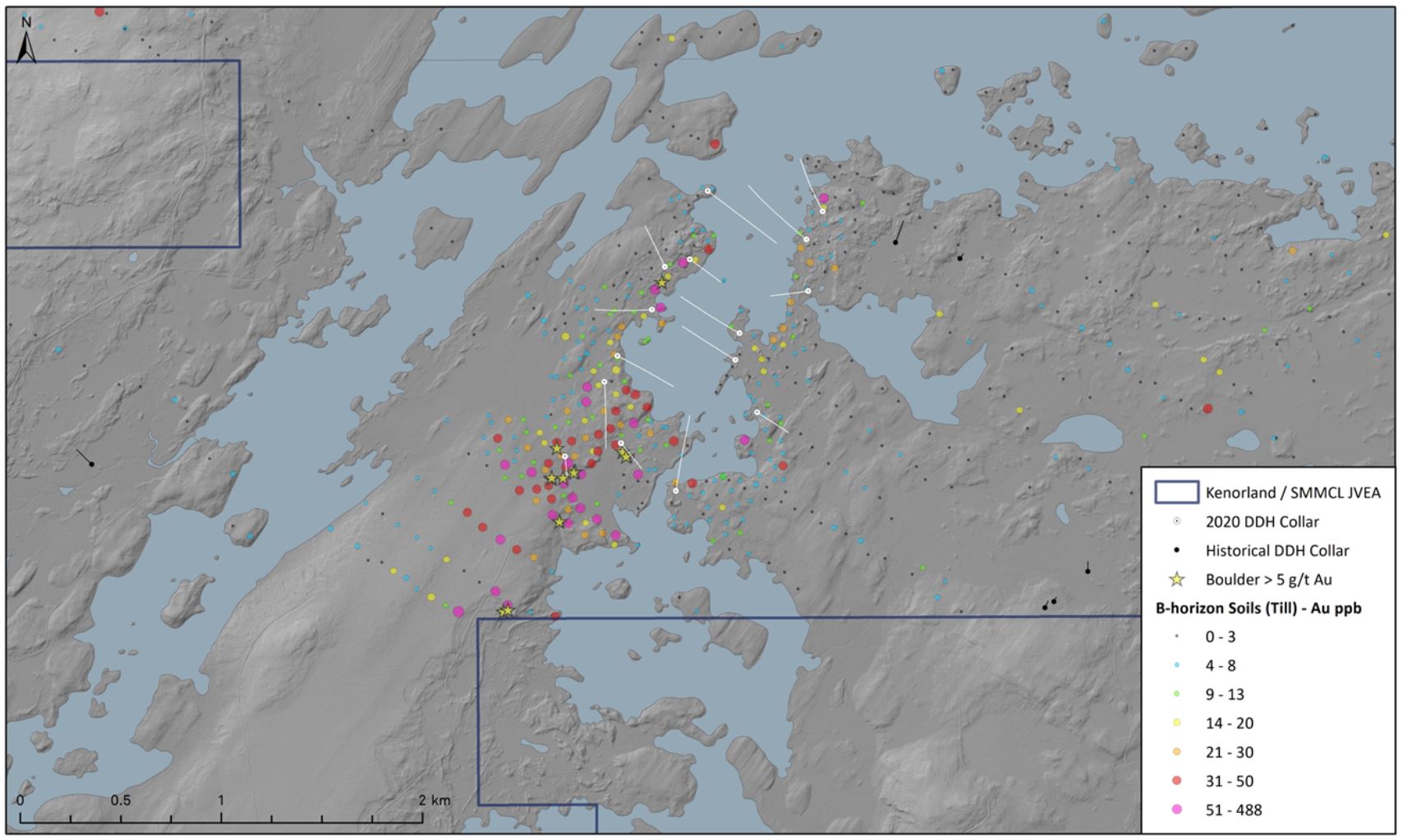

Figure 1. Results of 2018 and 2019 regional soil sampling programs

The 2020 first pass drill program at the Regnault target area follows two seasons of systematic grassroots exploration. In summer of 2018, the initial 55,921 ha property was geochemically screened using B-horizon soil sampling (glacial till substrate) on a 1500m x 150m grid. In 2019, areas of gold-in-soil anomalism found in the 2018 survey were followed up with infill soil sampling, till sampling, boulder prospecting, geological mapping, airborne magnetics, and LIDAR surveys. An extensive 3km by 1km gold-in-soil anomaly/dispersion train was defined that contained up to 283 gold grains (159 pristine grains) and boulders assaying up to 408 g/t Au. 43 of 115 boulder samples within the soil anomaly returned assays greater than 0.1 g/t Au while ten boulders returned assays greater than 10g/t Au. Due to the absence of any outcrop in the area, drill targeting for the 2020 drill program relied on interpretation from high resolution drone magnetics, 3D IP, and surface geochemistry, including location of mineralized boulders.

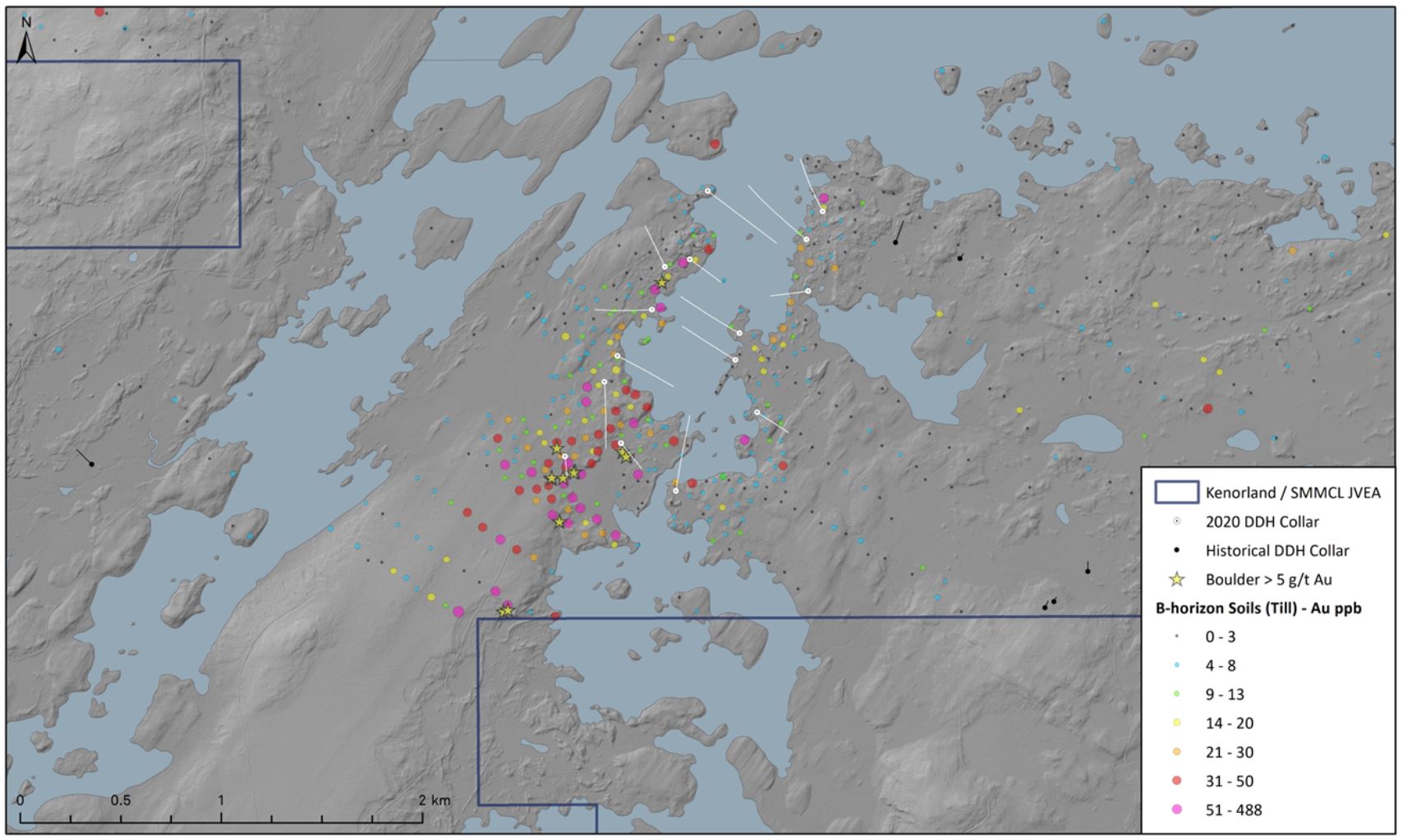

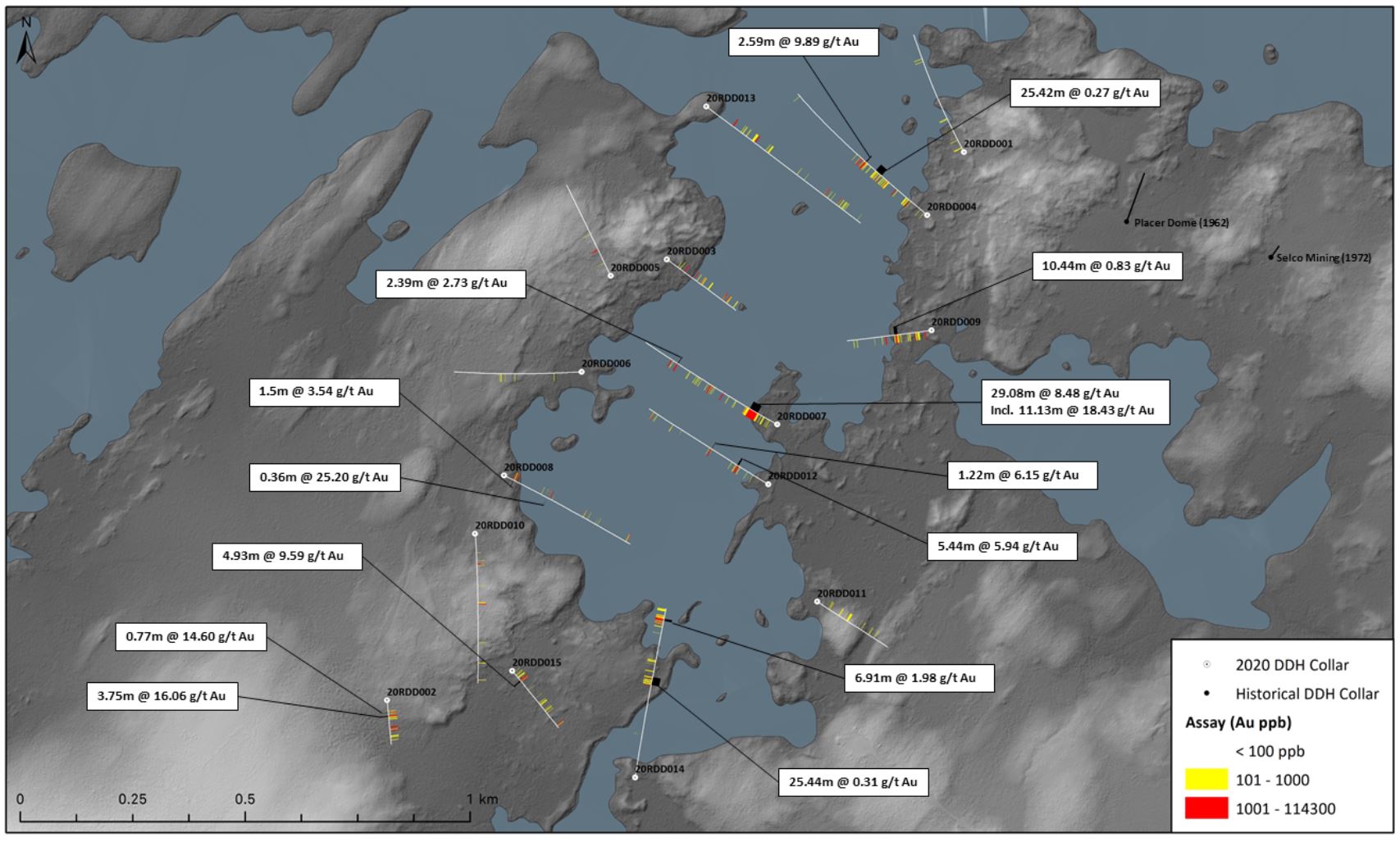

Within the immediate Regnault target area there are no recorded mineral occurrences or historical drilling. There are two historical drillholes (drilled in 1962 and 1972 respectively) located approximately 500m to the east of the target area which had tested buried EM conductors within the in surrounding volcanic rocks with no significant reported intercepts. The Regnault target is located 5km from the provincially maintained Route du Nord and is accessed by pre-existing logging roads.

Figure 2. Map of the Regnault Target Area

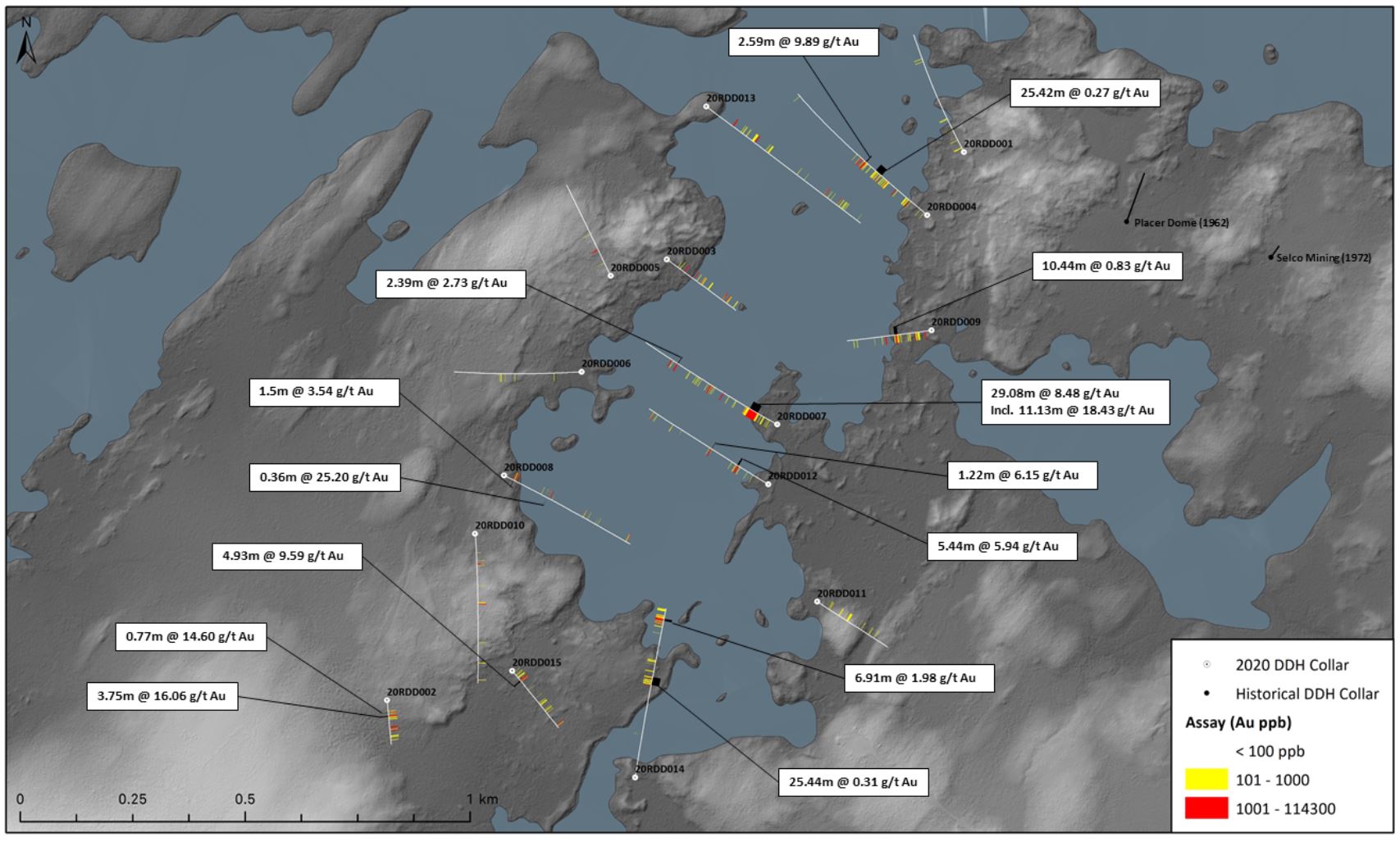

Figure 3. Plan map of the 2020 drill program

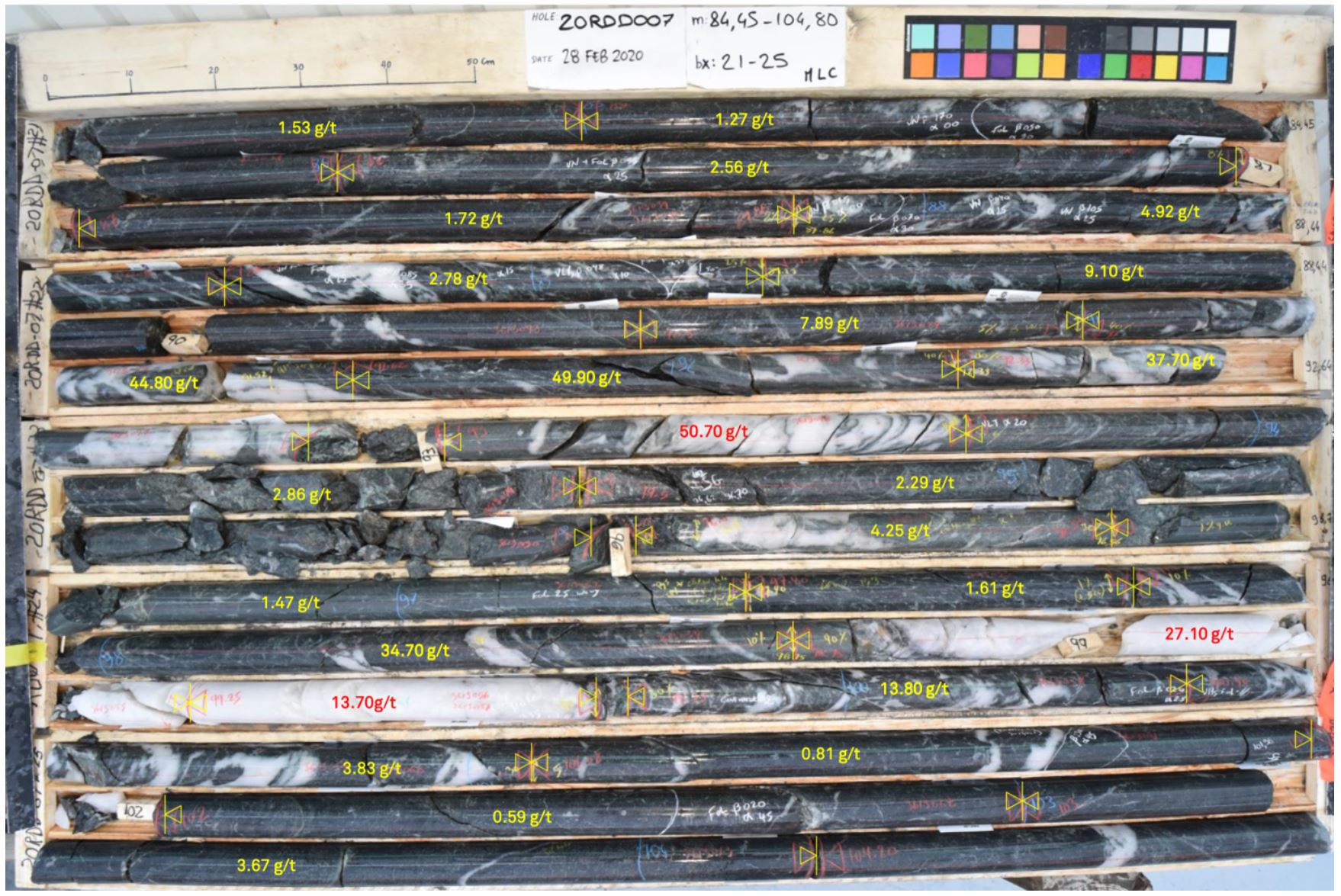

Figure 4. Drill core from 20RDD007 (84.45m – 104.80m)

Zach Flood, President and CEO of Kenorland states: “The results from the maiden drill program at Regnault are nothing short of amazing. We have found a new significant gold system just a few kilometers off the Route du Nord in Quebec, completely concealed undercover, through systematic grassroots exploration. We have blindly intersected multiple gold bearing structures at various orientations in an area over 1.5 kilometers long and 500 meters wide. There remains a significant amount of strike length, indicated by boulders and soil geochemistry, which has yet to be touched and which we plan to aggressively explore in the coming months ahead. The results announced are the outcome of a sustained effort over multiple seasons, in collaboration with, and support from, our partners at Sumitomo Metal Mining. The discovery here highlights the potential to make further incredible grassroots discoveries in Quebec and elsewhere, even in areas that have been considered heavily prospected in the past.”

Kenorland Enters into Letter of Intent with Northway Resources Corp. for Proposed Reverse Takeover

The Company also announces that it has entered into a letter of intent dated July 28, 2020 whereby Northway Resources Corp. (NTW.V) (“Northway) will acquire all of the issued and outstanding securities of Kenorland by way of a share exchange, amalgamation or such other form of business combination as the parties may determine. As Kenorland is the holder of 6,000,000 common shares of Northway, representing 14.50% of its issued and outstanding shares (18.44% on a partially diluted basis), the Transaction constitutes a ‘related party transaction’ as defined in Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions. As a result, the completion of the Transaction will be subject to approval by the majority of the minority Northway shareholders.

Pursuant to the Transaction, Northway will complete a two old for one new share consolidation (the “Consolidation”) and will issue common shares (“NTW Shares”) to the holders of common shares in the capital of Kenorland (“Kenorland Shares”) on the basis of approximately two post-Consolidation NTW Shares for each Kenorland Share. It is anticipated that approximately 30.05 million post-Consolidation NTW Shares will be issued pursuant to the Transaction based on the current capital structure of Kenorland.

The Transaction is subject to a number of terms and conditions, including, but not limited to, the parties entering into a definitive agreement with respect to the Transaction on or before August 31, 2020 (such

agreement to include representations, warranties, conditions and covenants typical for a transaction of this nature), the completion of satisfactory due diligence investigations, the completion of a private placement by Northway, the completion of the Consolidation and the approval of the TSX Venture Exchange and other applicable regulatory authorities.

About the Frotet Project

The Frotet Project was first identified by Kenorland in 2017 after completing a regional prospectivity study over the Abitibi and Frotet-Evans Greenstone Belts. The Frotet-Evans greenstone belt hosts the Troilus Au-Cu deposit which produced more than two million ounces of gold of and ~70,000 tons of Cu from 1996-2010 and currently contains 3.97Moz Au indicated and 1.53Moz Au inferred (Troilus Gold website) . The initial 55,921 ha property was acquired through map staking in March, 2017 and then optioned to SMMCL in April, 2018. The two staged earn-in agreement allows SMMCL to earn 65% by funding C$4.3 million in expenditures over an initial three years. SMMCL then has the option to earn an additional 15% (80% total) by funding another C$4 million over the following year. Once a joint venture is formed, any party which is diluted below a 10% interest will convert their interest to a 2% uncapped net smelter royalty.

QA/QC and Core Sampling Protocols

All drill core samples were collected under the supervision of the company employees. Drill core was transported from the drill platform to the logging facility where it was logged, photographed, and split by diamond saw prior to being sampled. Samples were then bagged, and blanks and certified reference materials were inserted at regular intervals. Groups of samples were placed in large bags, sealed with

numbered tags in order to maintain a chain-of-custody, and transported from Chibougamau to BV laboratory in Timmins, Ontario.

Sample preparation and analytical work for this drill program was carried out by Bureau Veritas Commodities, Timmins, Ontario. Samples were prepared for analysis according to BV method PRP70-250: individual samples were crushed to 2mm and a 250g split was pulverized for analysis and then assayed for Gold. Gold in samples was analysed by fire assay with AAS finish and over-limits re-analyzed gravimetrically. In zones with macroscopic gold the samples were first screened, and the fine fraction was fire assayed with AAS finish. All results passed the QAQC screening at the lab, all company inserted standards and blanks returned results that were within acceptable limits.

Qualified Persons

Thomas Hawkins, P.Geo. (OGQ #2200), geologist, Vice President, Exploration of Kenorland Minerals Ltd., Qualified Person under NI 43- 101 on standards of disclosure for mineral projects, has reviewed and approved the technical content of this release.

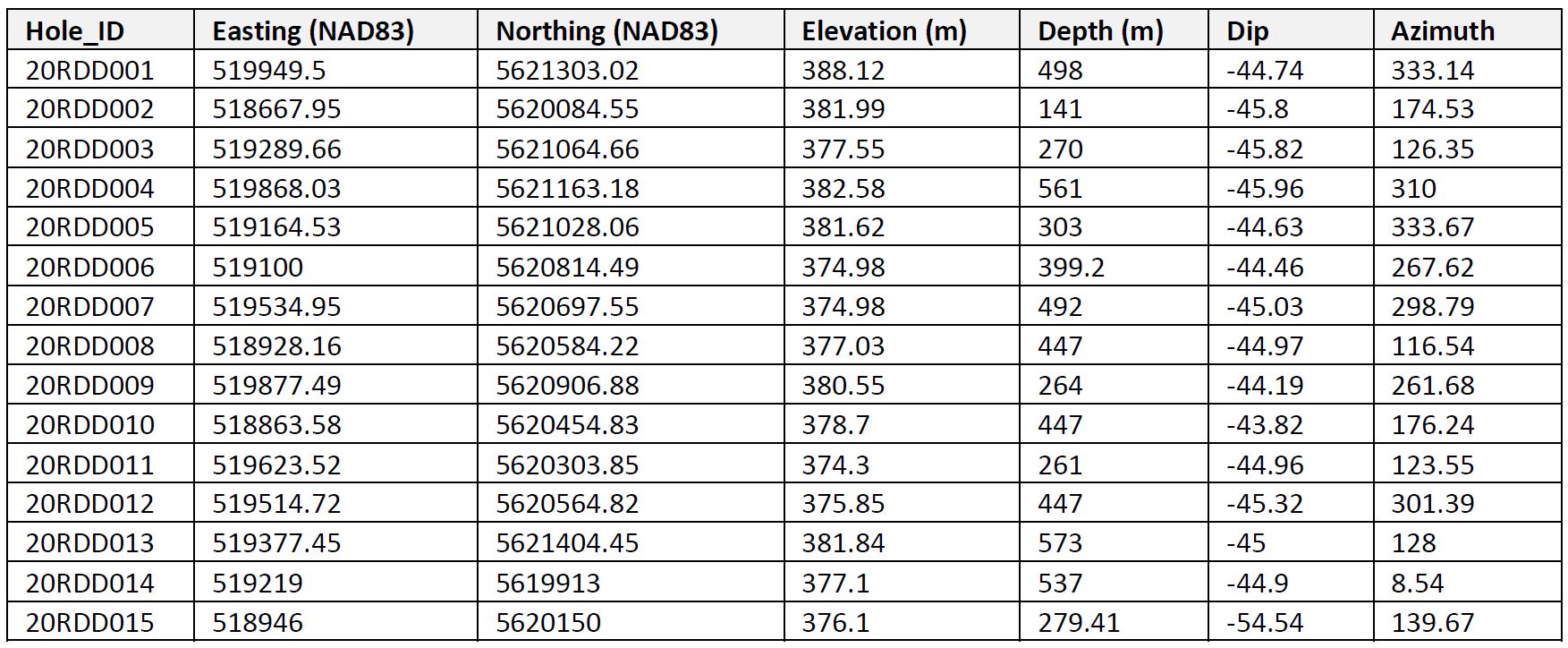

Table 2. Drillhole location and collar table

About Kenorland Minerals

Kenorland is a private exploration company incorporated under the laws of the Province of British Columbia and based in Vancouver, British Columbia, Canada. Kenorland’s business model is project generation focused on early to advanced stage exploration assets. The company currently holds three properties where work is being completed under an earn-in agreement from third parties. The Frotet and Chicobi Projects, which are both located in Quebec, Canada, are optioned to Sumitomo Metal Mining Canada Ltd. and the Chebistuan Project, also located in Quebec, is optioned to Newmont Mining. The company also owns 100% of the advanced stage Tanacross porphyry Cu, Au, Mo project in Alaska, USA.

Further information can be found on the Company’s website www.kenorlandminerals.com

Kenorland Minerals Ltd.

Zach Flood

President and CEO

Tel: +1 604 363 1779

zach@kenorlandminerals.com

Kenorland Minerals Ltd.

Francis MacDonald

Executive Vice President, Exploration

Tel: +1 778 322 8705

francis@kenorlandminerals.com

Forward-Looking statements

This news release contains forward-looking statements and forward-looking information (together, “forward-looking statements”) within the meaning of applicable securities laws. All statements, other than statements of historical facts, are forward-looking statements. Generally, forward-looking statements can be identified by the use of terminology such as “plans”, “expects’, “estimates”, “intends”, “anticipates”, “believes” or variations of such words, or statements that certain actions, events or results “may”, “could”, “would”, “might”, “will be taken”, “occur” or “be achieved”. Forward looking statements involve risks, uncertainties and other factors disclosed under the heading “Risk Factors” and elsewhere in the Company’s filings with Canadian securities regulators, that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking statements. Although the Company believes that the assumptions and factors used in preparing these forward-looking statements are reasonable based upon the information currently available to management as of the date hereof, actual results and developments may differ materially from those contemplated by these statements. Readers are therefore cautioned not to place undue reliance on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed times frames or at all. Except where required by applicable law, the Company disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.