Kenorland Intersects 19.50 g/t Au over 6.65m on R6 vein discovery at the Frotet Project, Quebec

July 11, 2022

Vancouver, British Columbia, July 11, 2022 – Kenorland Minerals Ltd. (TSXV:KLD) (OTCQX:NWRCF) (FSE:3WQ0) (“Kenorland” or “the Company”) is pleased to announce final drill results from the 2022 winter drill program at the Frotet Project, (“the Project”), located in northern Quebec and held under joint venture (“the Joint Venture”) with Sumitomo Metal Mining Canada Ltd. (“SMMCL”). Assays from the remaining 5 of 25 drill holes completed, including 2,840 meters of the 10,880 meter program are reported herein. The Company is also pleased to provide an update on its summer drill program and exploration activities currently underway at the Project.

Drill highlights include the following:

- 22RDD133: 6.65m at 19.50 g/t Au incl. 1.06m at 98.34 g/t Au at R6 (new vein discovery)

- 22RDD135: 1.70m at 25.00 g/t Au incl. 0.45m at 87.00 g/t Au at R1

- 22RDD135: 5.00m at 5.46 g/t Au incl. 0.90m at 21.39 g/t Au at R8 (new vein discovery)

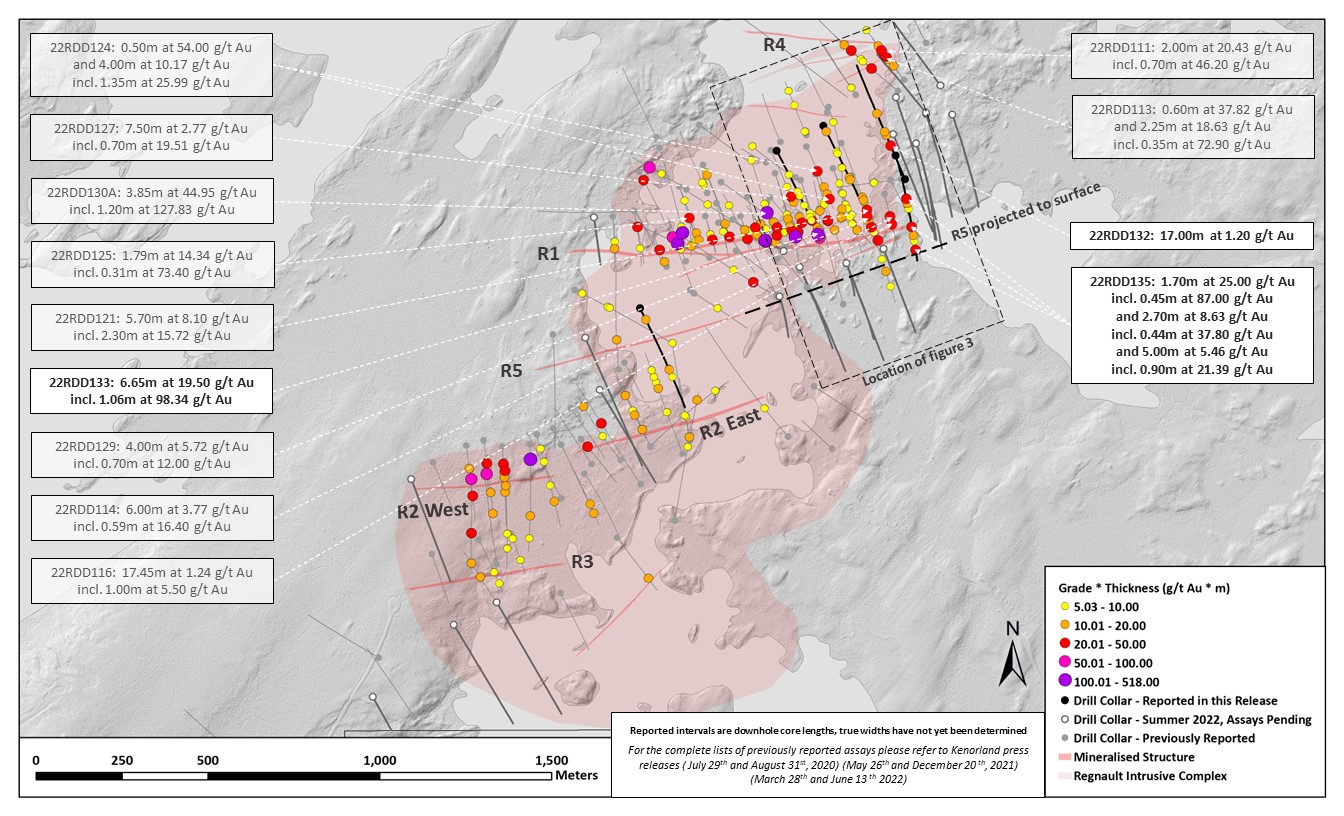

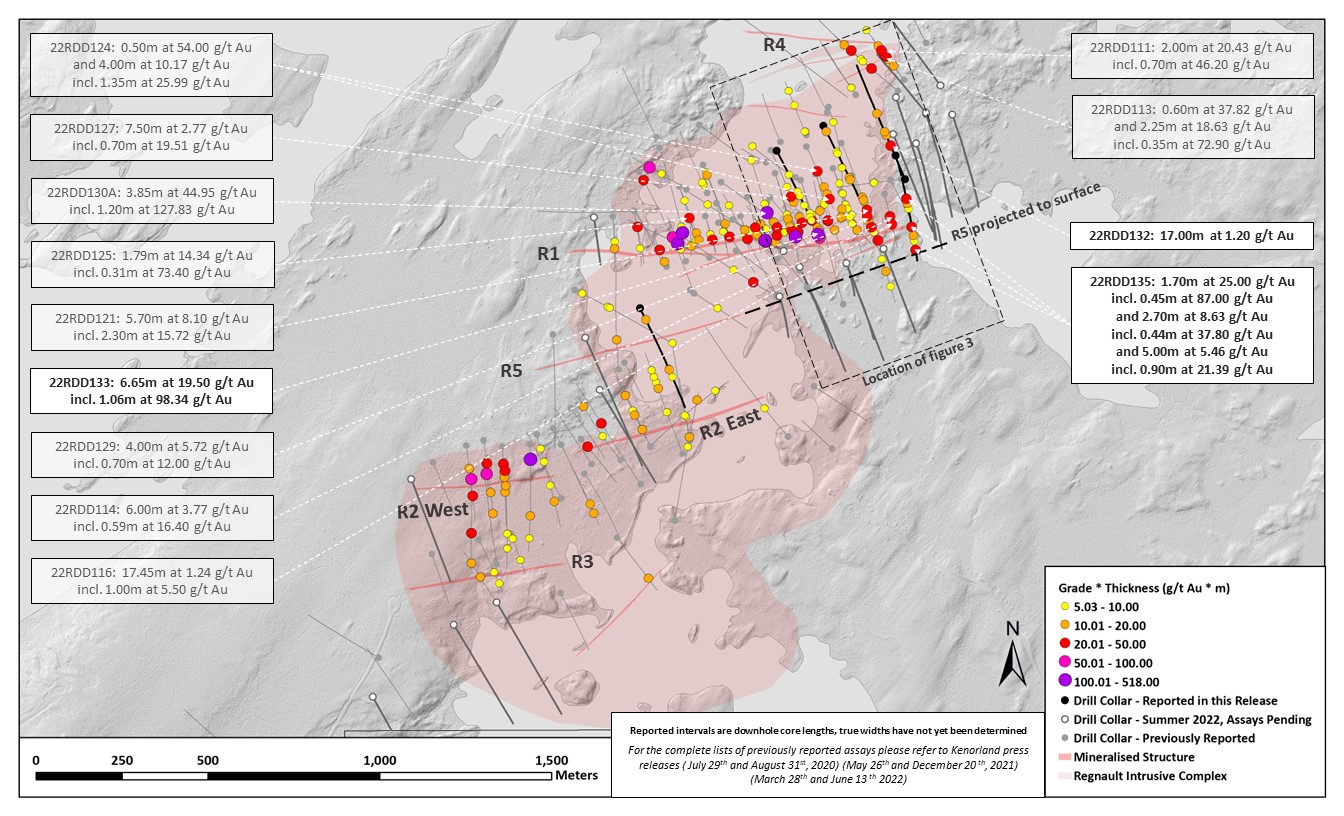

Figure 1. Plan map of Regnault drilling including highlights from the 2022 winter drill program

Zach Flood, CEO of Kenorland Minerals states, “The drill program completed in the first quarter was a massive success. The first holes to intersect the newly discovered veins parallel to the R1 structure, including R5, R6, R7 and R8, are initially returning very impressive grades and widths such as today’s announcement of 22RDD133, which reported 19.50 g/t Au over 6.65m. Results from these new vein discoveries are easily comparable to some of the best results from the R1 structure, which we’ve been drilling off since the initial discovery in 2020. This is great news for the Joint Venture and we look forward to further results from the recently completed summer drill campaign, which was largely focussed on following up these discoveries.”

Discussion of Results

The reported 5 drill holes (2,840m) are the final results from the 2022 winter drill program at Regnault. Drilling was designed to expand the strike extent along the R2 and R4 trends, testing the down dip extents of the R1 mineralised structure, and explore for additional mineralised structures immediately to the south of R1.

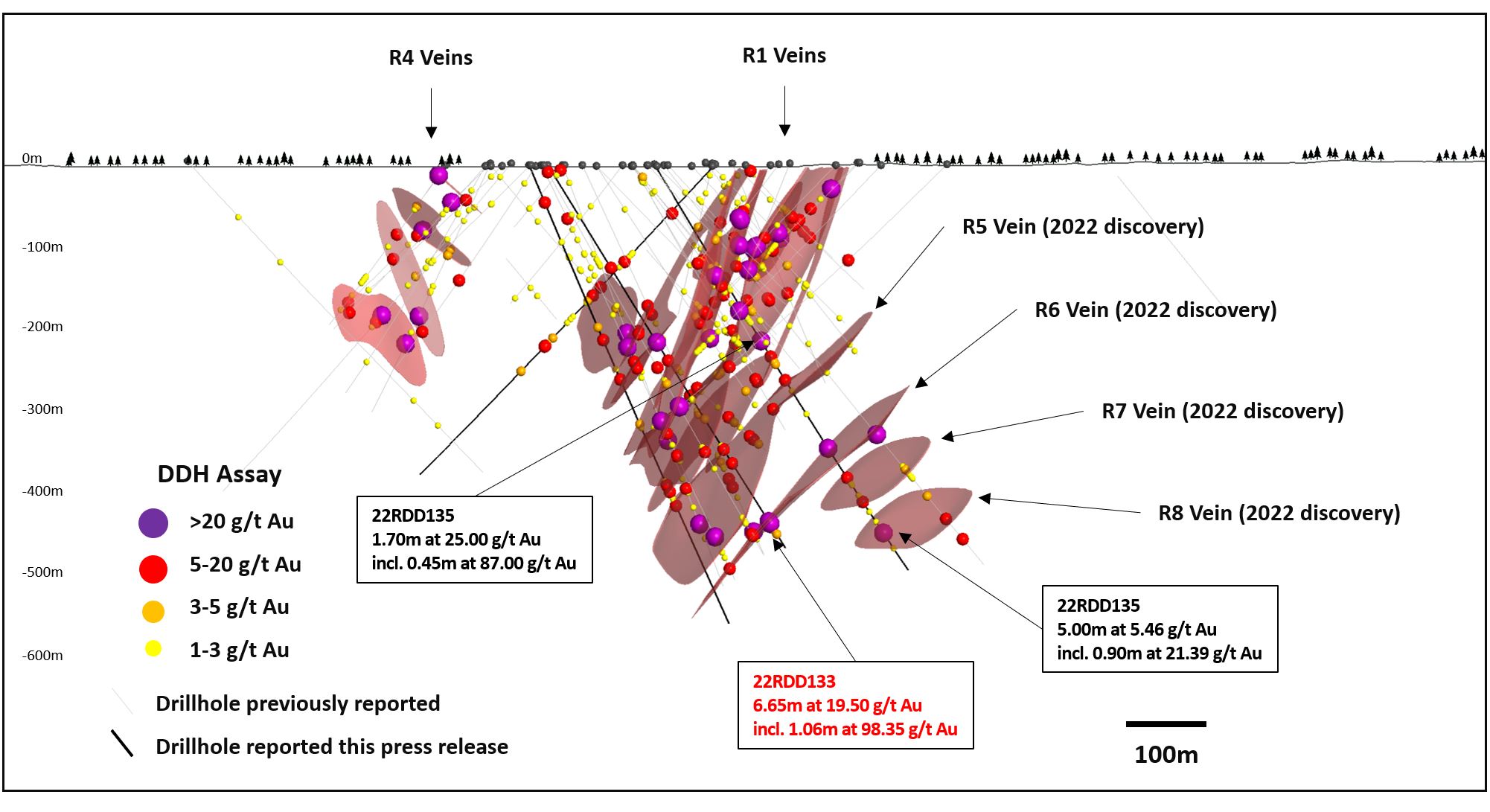

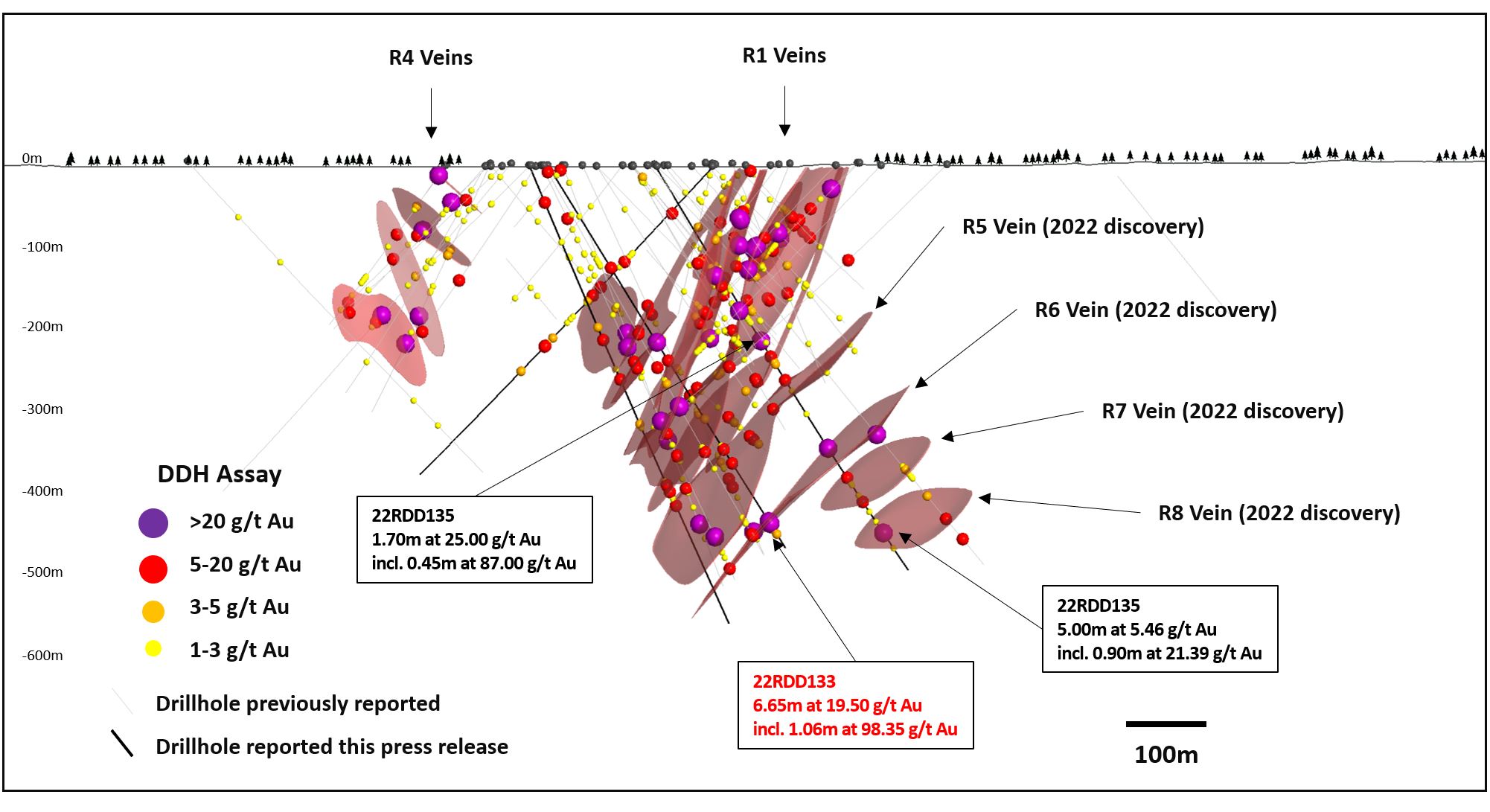

Along the R1 trend, highlights include hole 22RDD135 which stepped 135m east from 22RDD129 (4.00m at 5.72 g/t Au*) and intersected 1.70m at 25.00 g/t Au incl. 0.45m at 87.00 g/t Au. Hole 22RDD135 is the most eastern drill hole along the R1 trend, demonstrating the potential for continued extension of high-grade mineralisation. Drilling has successfully extended mineralisation at R1 by over 100m to the east for a known strike length of 950m and to depths of 400m below surface remaining open along strike and at depth.

Directly to the south of the R1 drilling discovered multiple sub-parallel mineralised structures including R5, R6, R7 and R8, which have returned multiple high-grade intercepts. Hole 22RDD133 stepped 160m to the west of 22RDD121 (5.70m at 8.10 g/t Au*) and intersected 6.65m at 19.50 g/t Au incl. 1.06m at 98.34 g/t Au. Hole 22RDD135 returned 5.00m at 5.46 g/t Au incl. 0.90m at 21.39 g/t Au, a 130m step-out to the east from 22RDD129 (0.31m at 21.80 g/t Au*) and 170m step-out to the east up dip from 22RDD121 (5.70m at 8.10 g/t Au*). The discovery of these additional mineralised structures indicates the potential for further sub-parallel structures at depth in the Regnault system. These results extend the strike length of mineralisation along the newly discovered structures to 400m, and to 450m at depth remaining open along strike and at depth.

( * See press release dated June 13th 2021)

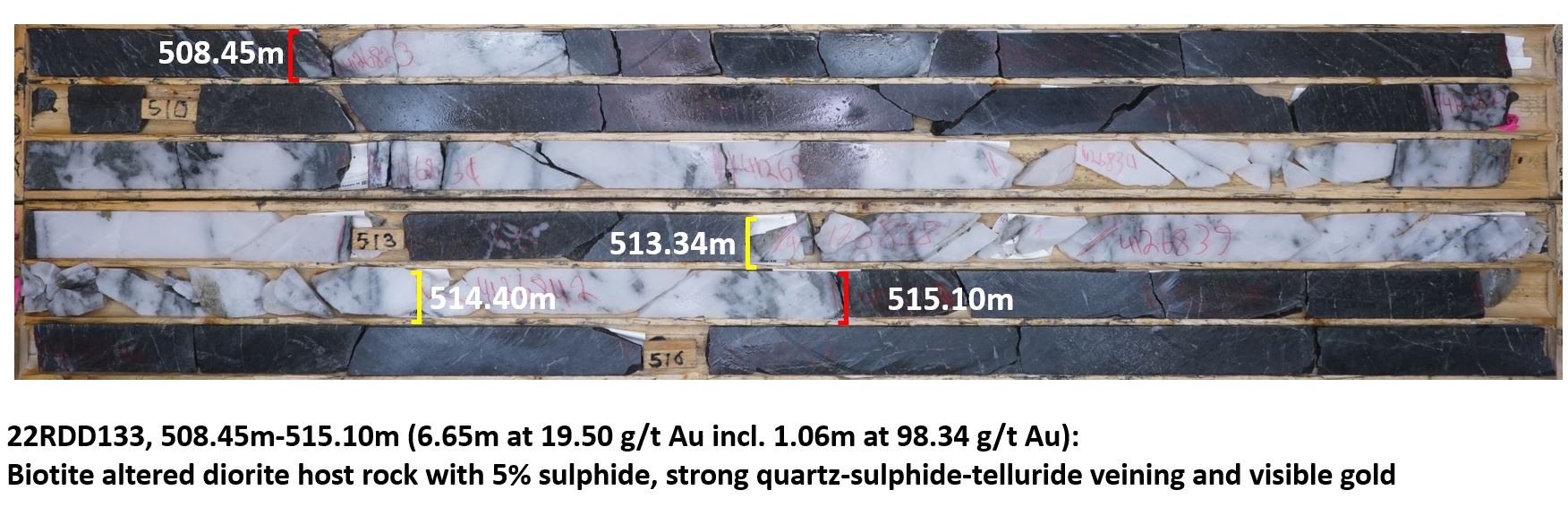

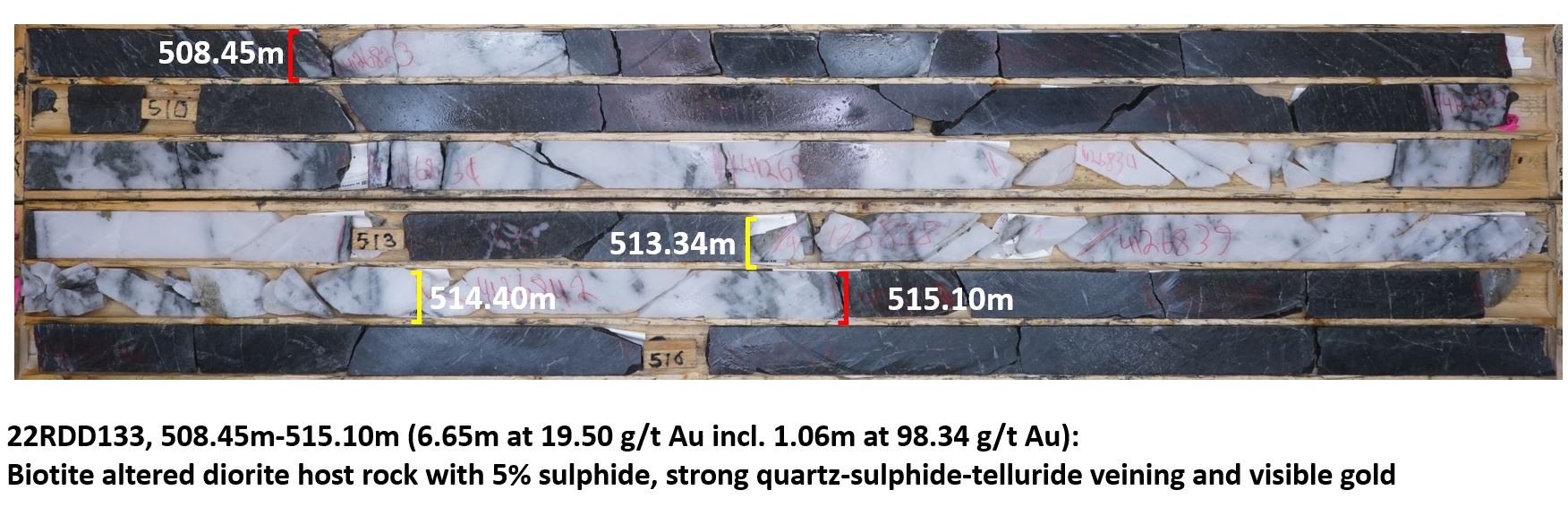

Figure 2. Core photo of 22RDD133 from newly discovered vein

Gold mineralisation along R1, R5, R6, R7 and R8 is associated with multiple east-west trending and north-dipping shear zones. Mineralised structures transect both the multiphase Regnault intrusive complex and surrounding volcanic rocks, and are defined by zones of moderate-strong strain, biotite-calcite ± silica-chlorite alteration and disseminated pyrite (locally ranging from 3-10%). High grade intercepts are characteristically shear-hosted laminated quartz-carbonate-pyrite veins, often haloed by variably deformed extensional stockwork quartz veining locally containing up to 20% pyrite along with trace chalcopyrite, Au ± Ag tellurides and visible gold.

Figure 3. Cross section through R1 and new vein discoveries (R5, R6, R7, R8) (500m section width; looking east)

Scott Smits, Vice President of Exploration states, “Its hard not to be excited about the steady high-grade intercepts we have received from the first quarter of 2022. Our strategy has been to aggressively step-out along the known trends and explore for additional mineralised structures, constantly growing the mineralised footprint at Regnault. These recent results continue to demonstrate the potential for further growth of this exceptional gold system.”

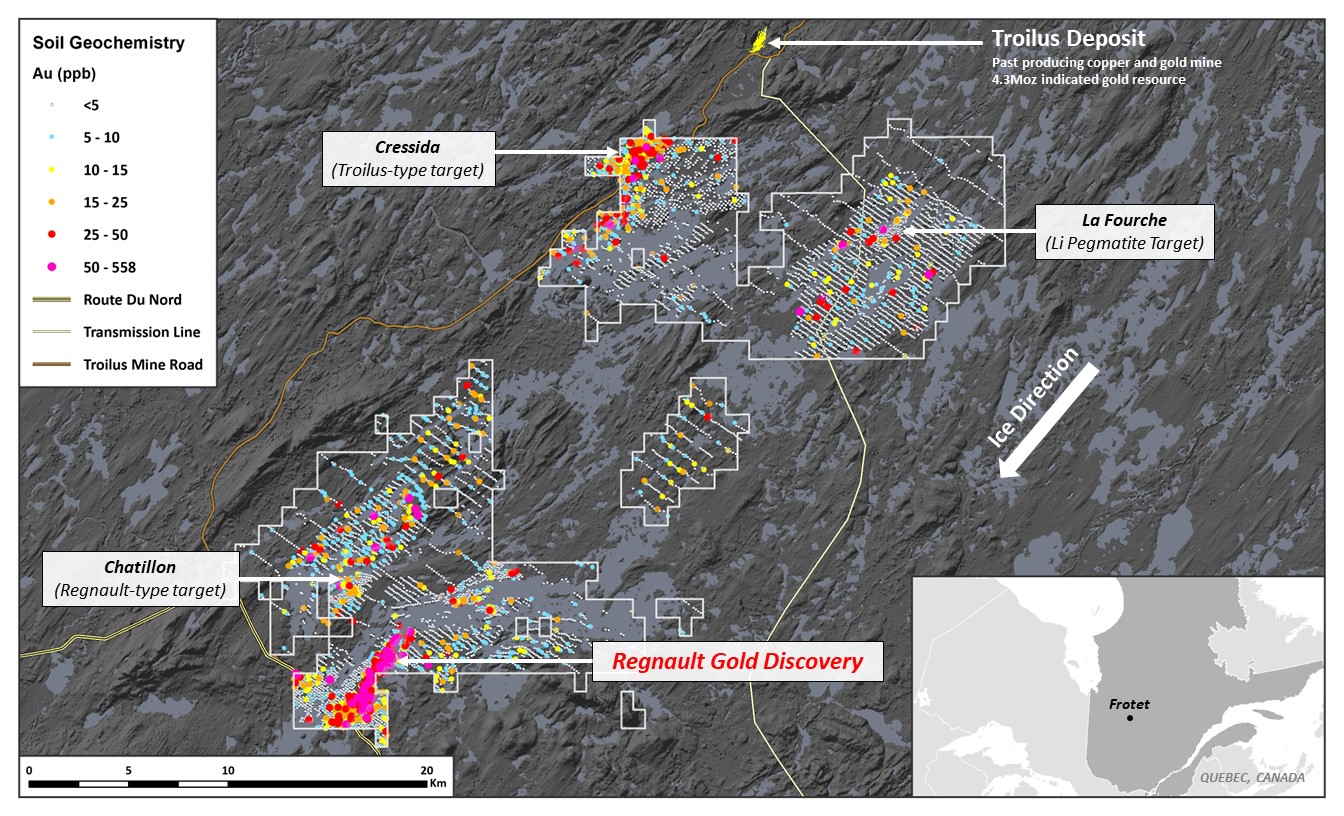

Upon completion of the Q1 2022 winter drill program and prior to the announcement of the company’s summer 2022 drill campaign a total of 45,086m had been drilled at Regnault including the initial discovery drill program in early 2020. Drilling is currently underway from the recently announced fiscal 2022 exploration budget (see press release dated May 3, 2022) which will include up to 40,000 meters of drilling carried out over two phases: a summer campaign from April to July of 2022, and a winter campaign from January to April of 2023. The company has recently completed the summer drill campaign at Regnault, consisting of 11,903m, and has now begun a first pass drill campaign at its regional Cressida target planned to include up to 2,500m of drilling (see press release dated June 13, 2022).

Regnault Summer 2022 Drill Program Update

Kenorland has recently completed the 2022 summer drill program at Regnault, which includes 11,903m from 23 drill holes. The program was designed to systematically step-out out along known mineralised structures and explore for additional sub-parallel structures to the south of the Regnault discovery area. Drilling was completed at broad-spaced step-outs along the R1 and newly discovered mineralised structures (R5, R6, R7 and R8) towards the east and at depth. Additional drill holes have tested the western extensions of these newly discovered structures. Visual indications of shear-related mineralisation including quartz-sulphide veining, biotite-calcite alteration and disseminated pyrite along with locally visible gold and tellurides continue to be intercepted beyond the previous limits of drilling. Drilling has successfully extended R1 mineralisation towards the east by greater than 100m for a known strike length of 950m and to depths of 400m below surface, remaining open. The newly discovered veins (R5, R6, R7 and R8) have been traced along strike for 450m and to depths of 500m below surface, also remaining open along strike and at depth.

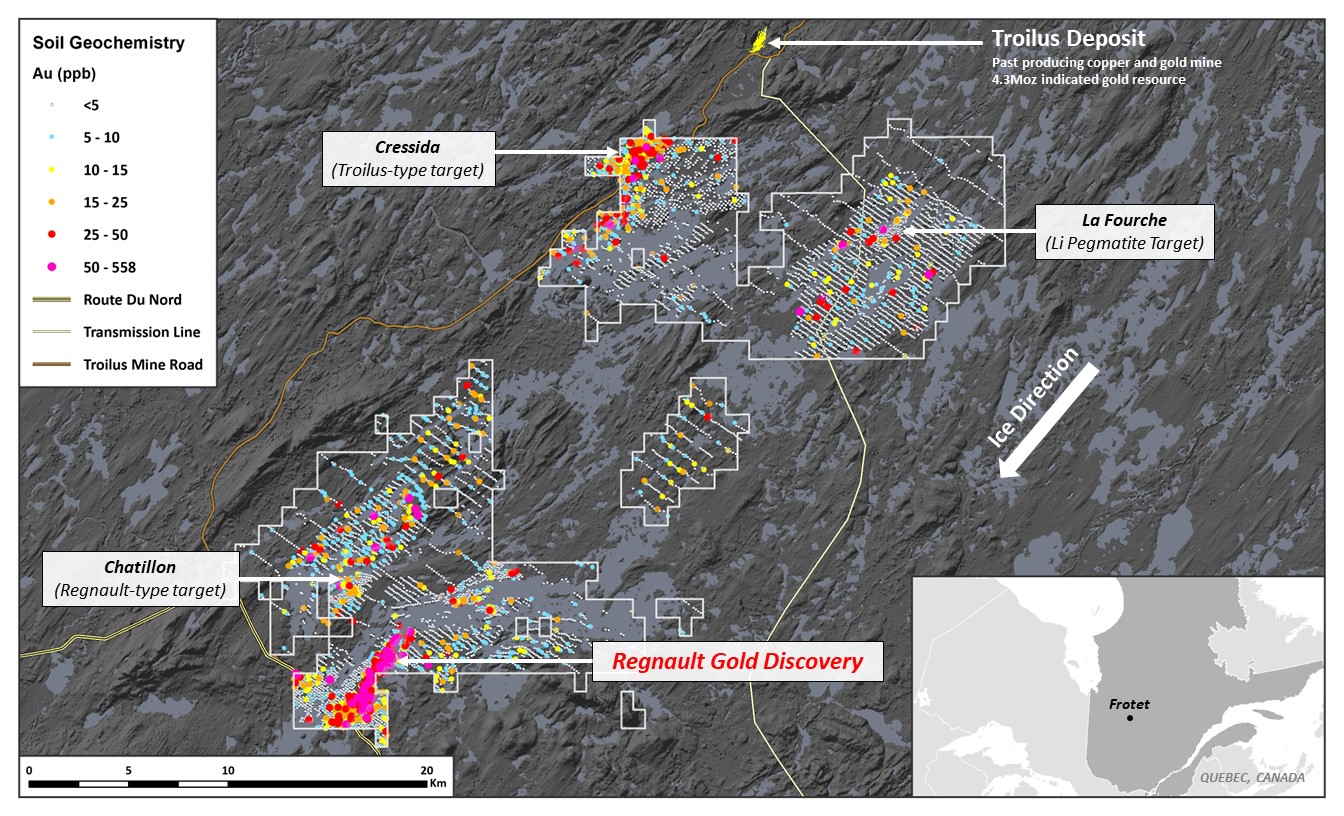

Frotet Regional Summer 2022 Drill Program Update

Drilling is currently underway at the Company’s Cressida target (figure 4). Approximately 2,500 meters of diamond drilling is planned for a first pass drill program at Cressida, located within the northwestern portion of the 39,365 hectare property. The Cressida target is located directly along strike and within the main mineralised corridor hosting the former producing Troilus Gold Mine, currently being explored by Troilus Gold Corp. The Cressida target is located between and along strike of Troilus Gold’s Southwest Zone (2.5km to the northeast) and their recently discovered Beyan Gold Zone (3km to the southwest). Drilling at Cressida is expected to be completed by mid-July.

Table 1. Table of results from the 2022 winter drill program

| Hole ID |

|

From (m) |

To (m) |

Interval (m) |

Au (g/t) |

Ag (g/t) |

Residual

Au (g/t) |

| 22RDD131 |

|

48.00 |

50.00 |

2.00 |

5.37 |

3.40 |

|

| And |

214.00 |

216.40 |

2.40 |

2.71 |

3.01 |

|

| And |

231.49 |

231.90 |

0.41 |

14.00 |

14.00 |

|

| And |

424.00 |

426.90 |

2.90 |

4.75 |

4.45 |

2.50 |

| Incl. |

424.40 |

425.10 |

0.70 |

11.82 |

10.15 |

|

| And |

433.60 |

452.54 |

18.94 |

0.91 |

1.28 |

|

| 22RDD132 |

|

147.50 |

164.50 |

17.00 |

1.20 |

0.74 |

|

| And |

202.80 |

205.00 |

2.20 |

5.32 |

4.05 |

3.03 |

| Incl. |

204.50 |

205.00 |

0.50 |

13.10 |

12.20 |

|

| And |

218.00 |

221.00 |

3.00 |

4.20 |

3.85 |

2.68 |

| Incl. |

218.50 |

219.00 |

0.50 |

11.80 |

9.60 |

|

| And |

301.00 |

304.30 |

3.30 |

3.97 |

3.53 |

2.45 |

| Incl. |

303.50 |

304.30 |

0.80 |

8.70 |

7.92 |

|

| 22RDD133 |

|

147.00 |

149.50 |

2.50 |

2.39 |

1.80 |

1.24 |

| Incl. |

147.00 |

147.50 |

0.50 |

6.97 |

5.70 |

|

| And |

253.85 |

254.15 |

0.30 |

24.00 |

18.70 |

|

| And |

278.60 |

280.65 |

2.05 |

4.78 |

5.05 |

|

| And |

335.00 |

338.60 |

3.60 |

1.67 |

1.16 |

|

| And |

407.00 |

408.20 |

1.20 |

7.06 |

3.63 |

4.05 |

| Incl. |

407.90 |

408.20 |

0.30 |

16.10 |

8.90 |

|

| And |

427.65 |

429.00 |

1.35 |

4.75 |

1.78 |

|

| And |

508.45 |

515.10 |

6.65 |

19.50 |

29.57 |

4.55 |

| Incl. |

513.34 |

514.40 |

1.06 |

98.34 |

160.31 |

|

| And |

521.60 |

534.50 |

12.90 |

0.98 |

1.04 |

|

| 22RDD134 |

|

31.00 |

31.30 |

0.30 |

14.90 |

13.00 |

|

| And |

68.17 |

68.78 |

0.61 |

30.80 |

7.00 |

|

| And |

351.90 |

356.55 |

4.65 |

1.19 |

0.95 |

|

| And |

358.47 |

363.82 |

5.35 |

2.88 |

3.08 |

1.61 |

| Incl. |

360.10 |

360.53 |

0.43 |

17.50 |

19.80 |

|

| And |

394.85 |

411.31 |

16.46 |

0.51 |

0.68 |

|

| 22RDD135 |

|

250.80 |

252.50 |

1.70 |

25.00 |

22.83 |

2.68 |

| Incl. |

251.25 |

251.70 |

0.45 |

87.00 |

79.10 |

|

| And |

273.50 |

281.30 |

7.80 |

1.68 |

1.28 |

|

| And |

307.50 |

309.80 |

2.30 |

2.30 |

1.05 |

|

| And |

405.90 |

408.60 |

2.70 |

8.63 |

3.18 |

2.95 |

| Incl. |

405.90 |

406.34 |

0.44 |

37.80 |

15.40 |

|

| And |

448.85 |

460.50 |

11.65 |

1.14 |

1.01 |

0.92 |

| Incl. |

448.85 |

449.29 |

0.44 |

6.75 |

5.20 |

|

| And |

484.00 |

484.60 |

0.60 |

15.60 |

2.20 |

|

| And |

527.50 |

532.50 |

5.00 |

5.46 |

3.77 |

1.96 |

| Incl. |

529.10 |

530.00 |

0.90 |

21.39 |

13.51 |

|

*Assay intervals reported are core lengths, true widths have not been determined

**Residual Au (g/t) represents the average grade of the drill hole interval excluding the highlighted internal interval

Table 2. Drill collar table of reported drill holes from the 2022 winter drill program

| Hole ID |

Easting (NAD83) |

Northing (NAD83) |

Elevation (m) |

Depth (m) |

Dip |

Azimuth |

| 22RDD131 |

519651 |

5621062 |

376 |

610.00 |

-66 |

150 |

| 22RDD132 |

519888 |

5620907 |

377 |

522.00 |

-47 |

339 |

| 22RDD133 |

519515 |

5620989 |

376 |

549.91 |

-56 |

157 |

| 22RDD134 |

519117 |

5620531 |

376 |

573.00 |

-57 |

151 |

| 22RDD135 |

519861 |

5620976 |

377 |

585.00 |

-59 |

163 |

About the Frotet Project

The Frotet Project was first identified by Kenorland in 2017 after completing a regional prospectivity study over the Abitibi and Frotet-Evans Greenstone Belts of Quebec. The initial 55,921 ha property was acquired through map staking in March, 2017 and optioned to Sumitomo Metal Mining Canada Ltd. (“SMMCL”), a wholly owned subsidiary of Sumitomo Metal Mining Co., Ltd. in April, 2018. Two years of property-wide systematic till sampling led to a maiden drill program in 2020 which resulted in a significant grassroots discovery at the prospect now named Regnault. The project is currently under the Joint Venture agreement between SMMCL and Kenorland Minerals Ltd., with interests being held at 80% and 20%, respectively. Under the Joint Venture, exploration is funded pro-rata and Kenorland is presently the operator of the project. Any party which does not contribute and is diluted below a 10% interest, converts its interest to an 2% uncapped net smelter royalty.

Figure 4. Map of Frotet Project showing regional till sampling geochemical results

QA/QC and Core Sampling Protocols

All drill core samples were collected under the supervision of Kenorland employees. Drill core was transported from the drill platform to the logging facility where it was logged, photographed, and split by diamond saw prior to being sampled. Samples were then bagged, and blanks and certified reference materials were inserted at regular intervals. Groups of samples were placed in large bags, sealed with numbered tags in order to maintain a chain-of-custody, and transported from Chibougamau to BV laboratory in Timmins, Ontario.

Sample preparation and analytical work for this drill program was carried out by Bureau Veritas Commodities (“BV”), Timmins, Ontario. Samples were prepared for analysis according to BV method PRP70-250: individual samples were crushed to 2mm (10 mesh) and a 250g split was pulverized to 75μm (200 mesh) for analysis and then assayed for Gold. Gold in samples were analyzed using BV method FA430 where a 30g split is analyzed with fire assay by Pb collection and AAS finish. Over-limits gold samples were re-analyzed using BV method FA530 where a 30g split is analyzed with fire assay by Pb collection and gravimetric finish. Multi-element geochemical analysis (45 elements) was performed on all samples using BV method MA200 where a 0.25g split is by multi-acid digest with ICP-MS/ES finish. All results passed the QAQC screening at the lab, all company inserted standards and blanks returned results that were within acceptable limits.

Qualified Person

Mr. Jan Wozniewski, B. Sc., P. Geo. (EGBC #172781, OGQ #2239) is the “Qualified Person” under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

About Kenorland Minerals

Kenorland Minerals Ltd. (TSX.V KLD) is a mineral exploration company incorporated under the laws of the Province of British Columbia and based in Vancouver, British Columbia, Canada. Kenorland’s focus is early to advanced stage exploration in North America. The Company currently holds four projects in Quebec where work is being completed under joint venture and earn-in agreement from third parties. The Frotet Project is held under joint venture with Sumitomo Metal Mining Co., Ltd., the Chicobi Project is optioned to Sumitomo Metal Mining Co., Ltd., the Chebistuan Project is optioned to Newmont Corporation, and the Hunter Project is optioned to Centerra Gold Inc. In Ontario, the Company holds the South Uchi Project under an earn-in agreement with a wholly owned subsidiary of Barrick Gold Corporation. In Alaska, USA, the Company owns 100% of the advanced stage Tanacross porphyry Cu-Au-Mo project as well as a 70% interest in the Healy Project, held under joint venture with Newmont Corporation.

Further information can be found on the Company’s website www.kenorlandminerals.com

Kenorland Minerals Ltd.

Zach Flood

CEO, Director

Tel: +1 604 363 1779

zach@kenorlandminerals.com

Kenorland Minerals Ltd.

Francis MacDonald

President

Tel: +1 778 322 8705

francis@kenorlandminerals.com

Cautionary Statement Regarding Forward Looking Statements

This news release contains forward-looking statements and forward-looking information (together, “forward-looking statements”) within the meaning of applicable securities laws. All statements, other than statements of historical facts, are forward-looking statements. Generally, forward-looking statements can be identified by the use of terminology such as “plans”, “expects’, “estimates”, “intends”, “anticipates”, “believes” or variations of such words, or statements that certain actions, events or results “may”, “could”, “would”, “might”, “will be taken”, “occur” or “be achieved”. Forward looking statements involve risks, uncertainties and other factors disclosed under the heading “Risk Factors” and elsewhere in the Company’s filings with Canadian securities regulators, that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking statements. Although the Company believes that the assumptions and factors used in preparing these forward-looking statements are reasonable based upon the information currently available to management as of the date hereof, actual results and developments may differ materially from those contemplated by these statements. Readers are therefore cautioned not to place undue reliance on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed times frames or at all. Except where required by applicable law, the Company disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.