Vancouver, British Columbia, August 21, 2023 – Kenorland Minerals Ltd. (TSXV: KLD) (OTCQX: KLDCF) (FSE: 3WQ0) (“Kenorland” or the “Company”) is pleased to announce the results of additional metallurgical testing of the Regnault gold system (“Regnault”) on the Frotet Project (the “Project”), located in northern Quebec and held under joint venture (the “Joint Venture”) with Sumitomo Metal Mining Canada Ltd. (“SMMCL”).

Metallurgical study highlights include:

- Optimized recoveries of up to 93.3% Au and 90.5% Ag for whole ore leaching

Results of the Additional Metallurgical Study

A preliminary metallurgical study at Regnault was initiated in July 2022 with the completion of drill hole 22RDD149 (29.20m at 16.61 g/t Au including 9.85m at 44.89 g/t Au*). The objective was to characterise the amenability of cyanide extraction of Au and Ag. Results of the study, summarised in a press release dated January 18, 2023, indicated promising Au-Ag recoveries, and identified additional steps to further maximize recovery. The follow up study investigated the effects of gravity separation prior to cyanide leaching, flotation prior to cyanide leaching, finer grinding, and the use of an activator to increase reaction kinetics during cyanide leaching. (*See press release dated November 14, 2022).

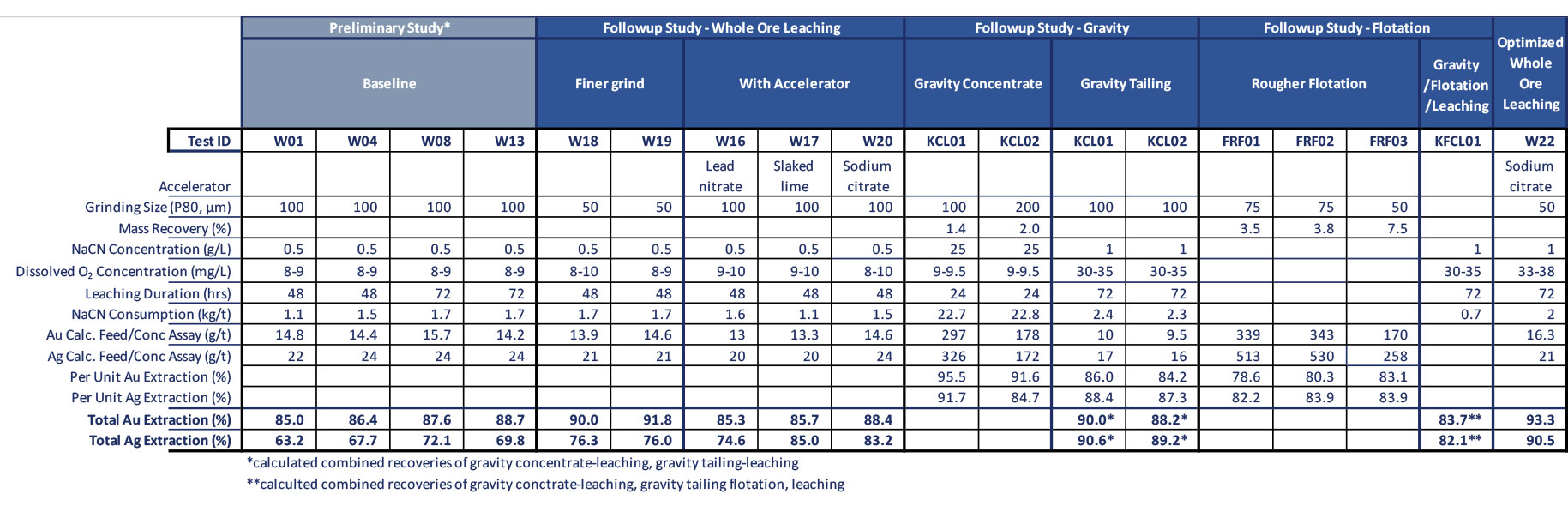

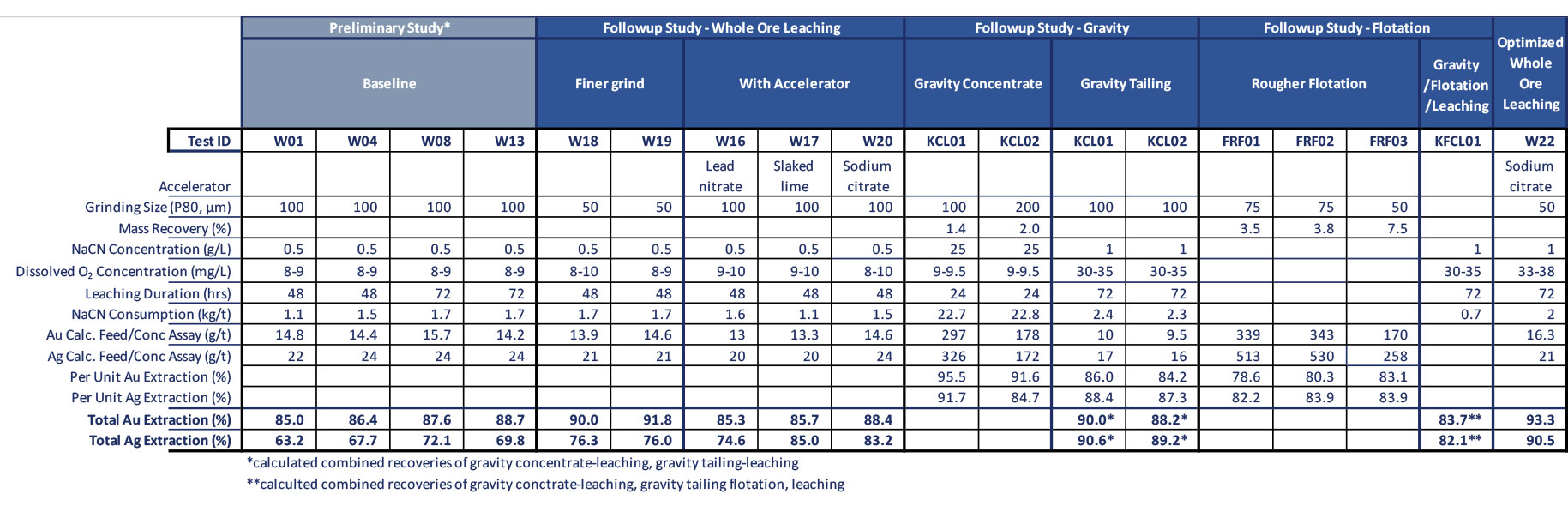

When comparing the different flowsheet options investigated for the Regnault style ore, the highest recoveries were realized with optimized whole ore leaching, with 93.3% Au and 90.5% Ag recovered. Combined gravity separation and cyanide leaching were 90.0% for Au and 90.6% Ag. Flotation testing when combined with gravity separation and cyanide leaching were lower than whole ore leaching, at 83.7% Au and 82.1% Ag. Compared to the whole ore leaching process the amount of cyanide contact material that would be reduced by flotation is 5.8% and cyanide consumption is reduced by 65.0%. These results indicate that the Regnault style ore is amenable to conventional cyanide leaching with recoveries of up to 93.3% Au and 90.5% Ag.

Details of the Metallurgical Study

Material from the original program (27.1m of NQ half drill core from 22RDD149) was used for the additional testing. Samples were crushed to under 1.7mm and thoroughly mixed. 1kg samples were split for head assay and various metallurgical testing. The composite head grade was 15.9 g/t Au and 24 g/t Ag. Mineral liberation analysis (MLA) identified gold-silver-telluride, electrum and native gold as the main gold and silver bearing mineral species.

The effects of grinding size on whole ore leaching from the preliminary study showed the highest Au recoveries (up to 89.9%) when decreasing grind size from baseline 100µm to 75µm. Testing from the follow up study reduced grind size to 50µm, increasing recoveries up to 91.8% for Au and 76.3% for Ag.

Whole ore leaching targeting 100µm grind size with the addition of extraction accelerators lead nitrate, sodium citrate, and slaked lime were investigated to improve reaction kinetics. Compared to baseline conditions, addition of sodium citrate increased Au recovery to 88.4% while the other reagents did not increase Au recoveries. Addition of any of the three accelerators resulted in increased Ag recovery, ranging from 71.9-85.0%.

Parameters of the whole ore leaching process that showed the most promise for maximizing recoveries were combined. Testing targeted 50µm in P80 grind size, leaching duration of 72hrs, 1.0 g/L NaCN concentration, increased pH of 12.5, dissolved oxygen content of 33-38 mg/L and addition of sodium citrate as an accelerator. This resulted in recoveries of 93.3% Au and 90.5% Ag, a marked increase when compared to initial study baseline conditions of 85.0-88.7% Au and 63.2-69.8% Ag.

Table 1: Summary of follow-up metallurgical study results

Gravity separation was investigated for the possibility of treating in a separate process. A 1kg sample split was ground to target grain sizes of 100µm, 200µm and 300µm in P80. The product was diluted and fed to a Knelson concentrator. Recoveries in the gravity concentrate were highest with the 100µm in P80 fraction at 30.2% for Au and 21.3% for Ag with a 1.4% mass recovery. The gravity concentrate was then subjected to intensive cyanide leaching, where Au and Ag recoveries were 95.5% and 91.7% on a per unit basis of the concentrate. The gravity tailing was also subjected to cyanide leaching, where recoveries of up to 86.0% Au and 88.4% Ag were realized. The combined effects of the gravity separation, intensive cyanide leaching of the concentrate and baseline leaching of the gravity tailing resulted in recoveries of 90.0% Au and 90.6% Ag.

For flotation testing, grinding of a 1kg split to target 75µm and 50µm in P80 was placed in a Denver flotation machine and pre-conditioned. Flotation time was split over 3, 7, 15, and 35 minutes, and the effect of higher pH and addition of thiophosphate type collector was investigated. Recoveries from the 50µm feed size were highest at 83.1% Au and 83.9% Ag with rougher concentrate mass recovery at 7.5%, recovery plateauing at 35 minutes flotation time. Recoveries improved marginally under higher pH conditions, while the addition of thiophosphate type collector did not appreciably improve recovery. The combined effect of gravity concentrate leaching, gravity tailing flotation and subsequent leaching was calculated at total recoveries of 83.7% for Au and 82.1% for Ag.

About the Frotet Project

The Frotet Project was first identified by Kenorland in 2017 after completing a regional prospectivity study over the Abitibi and Frotet-Evans Greenstone Belts of Quebec. The initial 55,921 ha property was acquired through map staking in March 2017 and optioned to Sumitomo Metal Mining Canada Ltd. (“SMMCL”), a wholly owned subsidiary of Sumitomo Metal Mining Co., Ltd. in April 2018. Two years of property-wide systematic till sampling led to a maiden drill program in 2020 which resulted in a significant grassroots discovery at the prospect now named Regnault. The Project is currently under a joint venture agreement between SMMCL and Kenorland Minerals Ltd., with interests being held at 80% and 20%, respectively. Under the joint venture, exploration is funded pro-rata and Kenorland is presently the operator of the Project. Any party which does not contribute and is diluted below a 10% interest, converts its interest to a 2% uncapped net smelter royalty.

Qualified Person

Cédric Mayer, M.Sc., P.Geo. (OGQ #02385), “Qualified Person” under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

About Kenorland Minerals Ltd.

Kenorland Minerals Ltd. (TSX.V: KLD) is a mineral exploration company incorporated under the laws of the Province of British Columbia and based in Vancouver, British Columbia, Canada. Kenorland’s focus is early to advanced stage exploration in North America. The Company currently holds five projects in Quebec where work is being completed under joint venture and earn-in agreements from third parties. The Frotet Project and Chicobi Project are held under joint venture with Sumitomo, the O’Sullivan Project is optioned to Sumitomo, the Chebistuan Project is optioned to Newmont Corporation and the Hunter Project is held under option to Centerra Gold Inc. In Alaska, the Company holds the advanced stage Tanacross porphyry Cu-Au-Mo project, optioned to Antofagasta, as well as a 70% interest in the Healy Project, held under joint venture with Newmont Corporation.

Further information can be found on the Company’s website www.kenorlandminerals.com

Kenorland Minerals Ltd.

Zach Flood

President, CEO and Director

Tel: +1 604 568 6005

info@kenorlandminerals.com

Cautionary Statement Regarding Forward Looking Statements

This news release contains forward-looking statements and forward-looking information (together, “forward-looking statements”) within the meaning of applicable securities laws. All statements, other than statements of historical facts, are forward-looking statements. Generally, forward-looking statements can be identified by the use of terminology such as “plans”, “expects’, “estimates”, “intends”, “anticipates”, “believes” or variations of such words, or statements that certain actions, events or results “may”, “could”, “would”, “might”, “will be taken”, “occur” or “be achieved”. Forward looking statements involve risks, uncertainties and other factors disclosed under the heading “Risk Factors” and elsewhere in the Company’s filings with Canadian securities regulators, that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking statements. Although the Company believes that the assumptions and factors used in preparing these forward-looking statements are reasonable based upon the information currently available to management as of the date hereof, actual results and developments may differ materially from those contemplated by these statements. Readers are therefore cautioned not to place undue reliance on these statements, which only apply as of the date of this news release, and no assurance can be given that such events will occur in the disclosed times frames or at all. Except where required by applicable law, the Company disclaims any intention or obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.